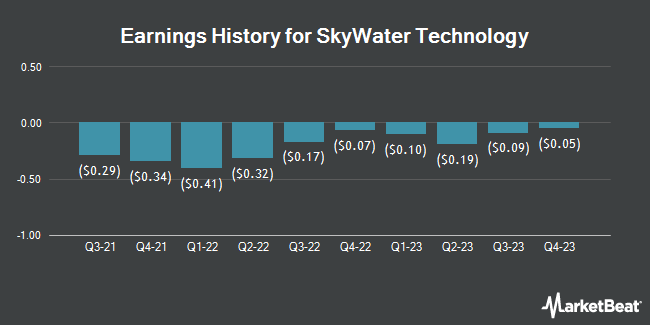

SkyWater Technology (NASDAQ:SKYT - Get Free Report) is anticipated to post its Q2 2025 quarterly earnings results after the market closes on Wednesday, August 6th. Analysts expect SkyWater Technology to post earnings of ($0.17) per share and revenue of $57.46 million for the quarter.

SkyWater Technology Price Performance

Shares of SkyWater Technology stock traded down $0.17 during trading on Friday, hitting $8.78. 844,827 shares of the company were exchanged, compared to its average volume of 630,532. The company has a quick ratio of 1.07, a current ratio of 1.18 and a debt-to-equity ratio of 0.57. SkyWater Technology has a fifty-two week low of $5.63 and a fifty-two week high of $19.00. The stock has a market capitalization of $421.70 million, a price-to-earnings ratio of -51.64 and a beta of 3.38. The firm has a 50 day moving average price of $9.64 and a 200 day moving average price of $8.84.

Insider Buying and Selling at SkyWater Technology

In other SkyWater Technology news, Director Loren A. Unterseher sold 366,418 shares of the business's stock in a transaction on Tuesday, May 27th. The stock was sold at an average price of $9.54, for a total value of $3,495,627.72. Following the completion of the transaction, the director directly owned 10,660,365 shares in the company, valued at approximately $101,699,882.10. The trade was a 3.32% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Thomas Sonderman sold 14,958 shares of the business's stock in a transaction on Thursday, June 26th. The shares were sold at an average price of $10.04, for a total value of $150,178.32. Following the completion of the transaction, the chief executive officer owned 565,465 shares of the company's stock, valued at $5,677,268.60. This trade represents a 2.58% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 729,982 shares of company stock valued at $6,933,545 over the last quarter. 37.85% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

An institutional investor recently raised its position in SkyWater Technology stock. AQR Capital Management LLC grew its stake in shares of SkyWater Technology, Inc. (NASDAQ:SKYT - Free Report) by 112.0% in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 313,993 shares of the company's stock after buying an additional 165,865 shares during the period. AQR Capital Management LLC owned 0.65% of SkyWater Technology worth $2,226,000 as of its most recent SEC filing. Institutional investors and hedge funds own 70.00% of the company's stock.

Analyst Ratings Changes

Several research analysts recently issued reports on the company. Needham & Company LLC cut their price objective on SkyWater Technology from $12.00 to $11.00 and set a "buy" rating for the company in a research report on Thursday, May 8th. TD Cowen cut their price target on SkyWater Technology from $15.00 to $12.00 and set a "buy" rating for the company in a report on Thursday, May 8th.

Get Our Latest Stock Report on SkyWater Technology

SkyWater Technology Company Profile

(

Get Free Report)

SkyWater Technology, Inc, together with its subsidiaries, operates as a pure-play technology foundry that engages in the provision of semiconductor development, manufacturing, and packaging services in the United States. The company offers engineering and process development support services to co-create technologies with customers; and semiconductor manufacturing services for various silicon-based analog and mixed-signal, micro-electromechanical systems, and rad-hard integrated circuits.

Further Reading

Before you consider SkyWater Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SkyWater Technology wasn't on the list.

While SkyWater Technology currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.