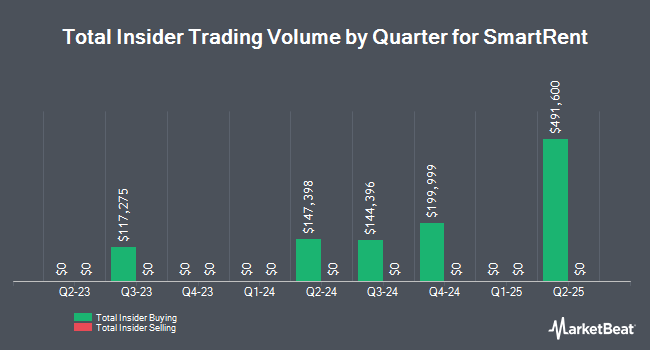

SmartRent, Inc. (NYSE:SMRT - Get Free Report) CEO Frank Martell purchased 120,000 shares of the firm's stock in a transaction on Friday, August 15th. The stock was bought at an average price of $1.35 per share, for a total transaction of $162,000.00. Following the purchase, the chief executive officer owned 748,204 shares in the company, valued at approximately $1,010,075.40. This represents a 19.10% increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink.

Frank Martell also recently made the following trade(s):

- On Tuesday, August 12th, Frank Martell bought 130,000 shares of SmartRent stock. The shares were acquired at an average price of $1.37 per share, for a total transaction of $178,100.00.

- On Monday, August 11th, Frank Martell bought 100,000 shares of SmartRent stock. The shares were acquired at an average price of $1.26 per share, for a total transaction of $126,000.00.

- On Friday, August 8th, Frank Martell bought 150,000 shares of SmartRent stock. The shares were acquired at an average price of $1.25 per share, for a total transaction of $187,500.00.

SmartRent Price Performance

Shares of NYSE SMRT traded down $0.0550 during mid-day trading on Wednesday, hitting $1.4450. 1,083,163 shares of the company's stock traded hands, compared to its average volume of 1,727,604. The company's 50-day moving average is $1.07 and its two-hundred day moving average is $1.07. The company has a market capitalization of $271.76 million, a P/E ratio of -3.80 and a beta of 1.82. SmartRent, Inc. has a 1 year low of $0.6710 and a 1 year high of $1.99.

SmartRent (NYSE:SMRT - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported ($0.06) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.04) by ($0.02). The business had revenue of $38.31 million for the quarter, compared to analysts' expectations of $38.85 million. SmartRent had a negative net margin of 46.54% and a negative return on equity of 14.94%. Equities analysts anticipate that SmartRent, Inc. will post -0.14 EPS for the current fiscal year.

SmartRent announced that its board has authorized a share buyback program on Wednesday, May 7th that permits the company to repurchase $50.00 million in outstanding shares. This repurchase authorization permits the company to purchase up to 27.7% of its shares through open market purchases. Shares repurchase programs are often a sign that the company's board of directors believes its stock is undervalued.

Hedge Funds Weigh In On SmartRent

A number of hedge funds have recently added to or reduced their stakes in SMRT. Vanguard Personalized Indexing Management LLC bought a new position in shares of SmartRent during the second quarter valued at approximately $27,000. Pallas Capital Advisors LLC lifted its position in SmartRent by 128.5% during the second quarter. Pallas Capital Advisors LLC now owns 30,788 shares of the company's stock valued at $30,000 after acquiring an additional 17,312 shares during the last quarter. Wealth Enhancement Advisory Services LLC lifted its position in SmartRent by 101.7% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 34,597 shares of the company's stock valued at $42,000 after acquiring an additional 17,444 shares during the last quarter. Jump Financial LLC purchased a new stake in SmartRent during the second quarter valued at approximately $42,000. Finally, Qube Research & Technologies Ltd purchased a new stake in SmartRent during the second quarter valued at approximately $43,000. 59.42% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

SMRT has been the topic of a number of recent analyst reports. Cantor Fitzgerald raised shares of SmartRent to a "hold" rating in a research report on Tuesday, April 22nd. Zacks Research raised shares of SmartRent to a "hold" rating in a research report on Friday, August 8th. Wall Street Zen raised shares of SmartRent from a "sell" rating to a "hold" rating in a research report on Sunday. Finally, Keefe, Bruyette & Woods increased their price objective on shares of SmartRent from $1.30 to $1.45 and gave the stock a "market perform" rating in a research report on Tuesday, August 12th. Three equities research analysts have rated the stock with a Hold rating, According to data from MarketBeat, SmartRent presently has an average rating of "Hold" and an average target price of $1.45.

Check Out Our Latest Stock Analysis on SmartRent

About SmartRent

(

Get Free Report)

SmartRent, Inc, an enterprise software company, provides an integrated smart home operating system to residential property owners and operators, homebuilders, institutional home buyers, developers, and residents in the United States. The company's products and solutions include smart apartments and homes, access control for buildings, common areas, and rental units, asset protection and monitoring, parking management, self-guided tours, and community and resident Wi-Fi.

See Also

Before you consider SmartRent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SmartRent wasn't on the list.

While SmartRent currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.