Sompo Asset Management Co. Ltd. lifted its stake in shares of Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 17.5% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 23,387 shares of the technology infrastructure company's stock after buying an additional 3,487 shares during the quarter. Sompo Asset Management Co. Ltd.'s holdings in Akamai Technologies were worth $2,237,000 as of its most recent filing with the SEC.

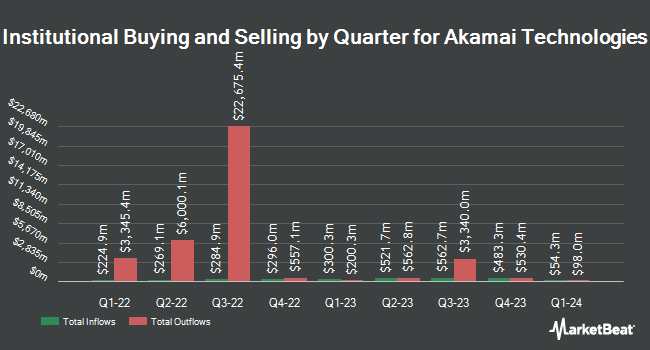

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Fuller & Thaler Asset Management Inc. grew its stake in Akamai Technologies by 7.8% during the 4th quarter. Fuller & Thaler Asset Management Inc. now owns 21,157 shares of the technology infrastructure company's stock valued at $2,024,000 after purchasing an additional 1,530 shares in the last quarter. Hsbc Holdings PLC raised its stake in shares of Akamai Technologies by 43.4% in the 4th quarter. Hsbc Holdings PLC now owns 778,208 shares of the technology infrastructure company's stock valued at $74,473,000 after purchasing an additional 235,394 shares in the last quarter. Tower Research Capital LLC TRC lifted its position in shares of Akamai Technologies by 317.1% during the fourth quarter. Tower Research Capital LLC TRC now owns 10,748 shares of the technology infrastructure company's stock worth $1,028,000 after purchasing an additional 8,171 shares during the last quarter. MML Investors Services LLC raised its stake in Akamai Technologies by 6.7% during the fourth quarter. MML Investors Services LLC now owns 22,841 shares of the technology infrastructure company's stock valued at $2,185,000 after buying an additional 1,435 shares in the last quarter. Finally, MetLife Investment Management LLC lifted its holdings in Akamai Technologies by 0.9% during the 4th quarter. MetLife Investment Management LLC now owns 39,735 shares of the technology infrastructure company's stock worth $3,801,000 after buying an additional 356 shares during the last quarter. 94.28% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, EVP Mani Sundaram sold 10,683 shares of the company's stock in a transaction dated Friday, March 7th. The shares were sold at an average price of $86.52, for a total transaction of $924,293.16. Following the transaction, the executive vice president now owns 23,988 shares in the company, valued at $2,075,441.76. This represents a 30.81 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Edward J. Mcgowan sold 4,652 shares of Akamai Technologies stock in a transaction on Monday, March 10th. The stock was sold at an average price of $86.48, for a total value of $402,304.96. Following the sale, the chief financial officer now directly owns 34,510 shares of the company's stock, valued at approximately $2,984,424.80. This trade represents a 11.88 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 31,394 shares of company stock worth $2,653,043 in the last three months. Insiders own 1.80% of the company's stock.

Akamai Technologies Price Performance

Shares of AKAM stock traded down $0.03 during mid-day trading on Monday, reaching $79.76. The company's stock had a trading volume of 579,249 shares, compared to its average volume of 1,932,790. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.33 and a current ratio of 1.23. The firm's 50-day moving average is $79.17 and its two-hundred day moving average is $90.85. Akamai Technologies, Inc. has a 1-year low of $67.51 and a 1-year high of $106.80. The company has a market cap of $11.65 billion, a P/E ratio of 24.48, a PEG ratio of 2.74 and a beta of 0.80.

Akamai Technologies (NASDAQ:AKAM - Get Free Report) last released its quarterly earnings data on Thursday, February 20th. The technology infrastructure company reported $1.19 earnings per share for the quarter, missing analysts' consensus estimates of $1.52 by ($0.33). The company had revenue of $1.02 billion for the quarter, compared to analyst estimates of $1.02 billion. Akamai Technologies had a net margin of 12.65% and a return on equity of 14.35%. On average, research analysts predict that Akamai Technologies, Inc. will post 4.6 earnings per share for the current year.

Analyst Ratings Changes

A number of research analysts have recently issued reports on the stock. Piper Sandler reduced their price target on shares of Akamai Technologies from $100.00 to $80.00 and set a "neutral" rating on the stock in a research report on Tuesday, April 8th. JPMorgan Chase & Co. decreased their price objective on Akamai Technologies from $76.00 to $72.00 and set an "underweight" rating for the company in a report on Friday, February 21st. TD Cowen lowered Akamai Technologies from a "buy" rating to a "hold" rating and reduced their price target for the stock from $125.00 to $98.00 in a research report on Friday, February 21st. Bank of America downgraded shares of Akamai Technologies from a "buy" rating to a "neutral" rating and reduced their price objective for the stock from $125.00 to $100.00 in a report on Friday, February 21st. Finally, Raymond James cut their target price on Akamai Technologies from $115.00 to $110.00 and set an "outperform" rating for the company in a research report on Friday, February 21st. One research analyst has rated the stock with a sell rating, ten have given a hold rating, ten have assigned a buy rating and two have assigned a strong buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $104.75.

Check Out Our Latest Stock Analysis on AKAM

Akamai Technologies Company Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Featured Articles

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.