Sotera Health (NASDAQ:SHC - Get Free Report)'s stock had its "sell (d)" rating reaffirmed by equities research analysts at Weiss Ratings in a report released on Wednesday,Weiss Ratings reports.

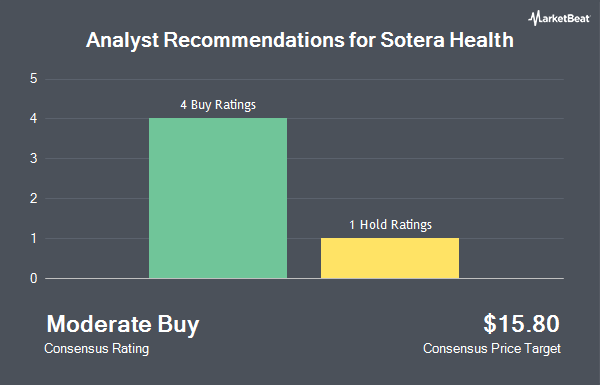

A number of other research analysts have also recently issued reports on SHC. Wall Street Zen upgraded Sotera Health from a "buy" rating to a "strong-buy" rating in a research note on Saturday, August 16th. Barclays lifted their price objective on Sotera Health from $17.00 to $19.00 and gave the company an "overweight" rating in a research note on Thursday, October 2nd. Four investment analysts have rated the stock with a Buy rating, one has given a Hold rating and one has assigned a Sell rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $17.20.

Get Our Latest Research Report on SHC

Sotera Health Trading Down 0.5%

SHC opened at $16.00 on Wednesday. The stock has a market cap of $4.54 billion, a PE ratio of 200.03 and a beta of 1.82. The company has a quick ratio of 2.23, a current ratio of 2.47 and a debt-to-equity ratio of 4.49. The business has a 50 day moving average of $15.33 and a 200-day moving average of $12.93. Sotera Health has a 52 week low of $9.53 and a 52 week high of $16.64.

Sotera Health (NASDAQ:SHC - Get Free Report) last announced its quarterly earnings data on Friday, August 8th. The company reported $0.20 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.17 by $0.03. The business had revenue of $294.34 million during the quarter, compared to analysts' expectations of $275.81 million. Sotera Health had a return on equity of 39.42% and a net margin of 2.14%.The firm's quarterly revenue was up 6.4% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.19 earnings per share. Sotera Health has set its FY 2025 guidance at 0.750-0.820 EPS. Equities research analysts predict that Sotera Health will post 0.61 earnings per share for the current fiscal year.

Insider Activity

In related news, Director Gtcr Investment Xi Llc sold 8,000,000 shares of Sotera Health stock in a transaction on Friday, September 5th. The stock was sold at an average price of $15.11, for a total value of $120,880,000.00. Following the completion of the sale, the director owned 41,215,301 shares of the company's stock, valued at $622,763,198.11. The trade was a 16.26% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Pincus & Co. Warburg sold 12,000,000 shares of Sotera Health stock in a transaction on Friday, September 5th. The stock was sold at an average price of $15.11, for a total value of $181,320,000.00. Following the completion of the sale, the director directly owned 61,822,952 shares of the company's stock, valued at $934,144,804.72. The trade was a 16.26% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 20,126,611 shares of company stock valued at $304,273,888 over the last ninety days. 47.55% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Sotera Health

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Farther Finance Advisors LLC lifted its position in shares of Sotera Health by 55.9% in the second quarter. Farther Finance Advisors LLC now owns 9,861 shares of the company's stock worth $110,000 after buying an additional 3,534 shares in the last quarter. Teacher Retirement System of Texas purchased a new stake in shares of Sotera Health in the first quarter worth about $266,000. Strs Ohio purchased a new stake in shares of Sotera Health in the first quarter worth about $1,003,000. Principal Financial Group Inc. lifted its position in shares of Sotera Health by 0.3% in the first quarter. Principal Financial Group Inc. now owns 352,388 shares of the company's stock worth $4,109,000 after buying an additional 1,037 shares in the last quarter. Finally, Public Employees Retirement System of Ohio lifted its position in shares of Sotera Health by 4.0% in the second quarter. Public Employees Retirement System of Ohio now owns 48,635 shares of the company's stock worth $541,000 after buying an additional 1,891 shares in the last quarter. 91.03% of the stock is currently owned by hedge funds and other institutional investors.

Sotera Health Company Profile

(

Get Free Report)

Sotera Health Company engages in the provision of sterilization, lab testing, and advisory services in the United States and internationally. The company operates through three segments: Sterigenics, Nordion, and Nelson Labs. It provides mission-critical end-to-end sterilization services, including gamma and electron beam irradiation, and ethylene oxide processing, as well as designs, installs, and maintains gamma irradiation systems.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sotera Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sotera Health wasn't on the list.

While Sotera Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.