Wall Street Zen lowered shares of Spyre Therapeutics (NASDAQ:SYRE - Free Report) from a hold rating to a sell rating in a research note published on Sunday.

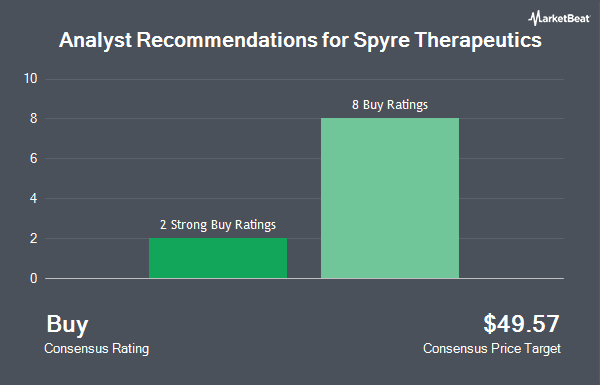

Separately, Wedbush restated an "outperform" rating and issued a $65.00 target price on shares of Spyre Therapeutics in a research report on Wednesday, August 6th. Two investment analysts have rated the stock with a Strong Buy rating and five have issued a Buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus target price of $53.40.

Read Our Latest Research Report on Spyre Therapeutics

Spyre Therapeutics Price Performance

SYRE stock traded down $0.23 during mid-day trading on Friday, reaching $16.49. 351,933 shares of the company traded hands, compared to its average volume of 456,133. The company has a market capitalization of $996.00 million, a P/E ratio of -4.85 and a beta of 2.87. Spyre Therapeutics has a 52-week low of $10.91 and a 52-week high of $40.26. The company has a fifty day moving average price of $16.33 and a 200-day moving average price of $16.22.

Spyre Therapeutics (NASDAQ:SYRE - Get Free Report) last issued its quarterly earnings data on Tuesday, August 5th. The company reported ($0.49) EPS for the quarter, topping the consensus estimate of ($0.73) by $0.24. As a group, analysts forecast that Spyre Therapeutics will post -4.46 EPS for the current year.

Hedge Funds Weigh In On Spyre Therapeutics

Several hedge funds have recently made changes to their positions in the business. Driehaus Capital Management LLC grew its stake in Spyre Therapeutics by 308.1% in the fourth quarter. Driehaus Capital Management LLC now owns 2,803,655 shares of the company's stock worth $65,269,000 after purchasing an additional 2,116,575 shares during the period. Jefferies Financial Group Inc. grew its stake in Spyre Therapeutics by 167.6% in the fourth quarter. Jefferies Financial Group Inc. now owns 1,216,954 shares of the company's stock worth $28,331,000 after purchasing an additional 762,147 shares during the period. Paradigm Biocapital Advisors LP grew its stake in Spyre Therapeutics by 39.3% in the first quarter. Paradigm Biocapital Advisors LP now owns 2,127,205 shares of the company's stock worth $34,322,000 after purchasing an additional 600,000 shares during the period. Deerfield Management Company L.P. Series C purchased a new stake in Spyre Therapeutics in the fourth quarter worth $10,476,000. Finally, Braidwell LP grew its stake in Spyre Therapeutics by 17.7% in the fourth quarter. Braidwell LP now owns 2,578,404 shares of the company's stock worth $60,025,000 after purchasing an additional 388,568 shares during the period. 80.39% of the stock is owned by hedge funds and other institutional investors.

About Spyre Therapeutics

(

Get Free Report)

Spyre Therapeutics, Inc, a preclinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD). It develops SPY001, a human monoclonal immunoglobulin G1 antibody designed to bind selectively to the a4ß7 integrin being developed for the treatment of IBD (ulcerative colitis and Crohn's disease).

Further Reading

Before you consider Spyre Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spyre Therapeutics wasn't on the list.

While Spyre Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.