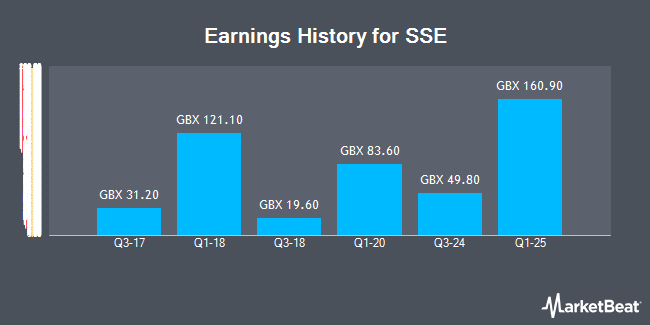

SSE (LON:SSE - Get Free Report) released its quarterly earnings results on Wednesday. The company reported GBX 160.90 ($2.18) EPS for the quarter, Digital Look Earnings reports. SSE had a return on equity of 17.83% and a net margin of 16.36%.

SSE Stock Performance

SSE stock traded up GBX 9 ($0.12) during trading hours on Monday, reaching GBX 1,752 ($23.71). 6,114,608 shares of the stock were exchanged, compared to its average volume of 17,784,332. SSE has a 52-week low of GBX 1,446.89 ($19.58) and a 52-week high of GBX 2,019 ($27.32). The stock has a market cap of £19.19 billion, a P/E ratio of 11.19, a P/E/G ratio of 3.06 and a beta of 0.56. The company has a debt-to-equity ratio of 82.62, a quick ratio of 0.50 and a current ratio of 1.10. The firm's 50 day moving average is GBX 1,627.52 and its 200 day moving average is GBX 1,614.69.

SSE Cuts Dividend

The company also recently disclosed a dividend, which was paid on Thursday, February 27th. Shareholders of record on Thursday, January 2nd were paid a GBX 21.20 ($0.29) dividend. The ex-dividend date was Thursday, January 2nd. This represents a yield of 1.25%. SSE's dividend payout ratio is currently 38.33%.

Insider Activity

In other SSE news, insider Alistair Phillips-Davies bought 31 shares of the business's stock in a transaction dated Thursday, February 27th. The stock was acquired at an average cost of GBX 1,508 ($20.41) per share, with a total value of £467.48 ($632.58). Insiders own 0.12% of the company's stock.

SSE Company Profile

(

Get Free Report)

SSE is an integrated energy group focused on regulated electricity networks and renewable energy with flexible generation.

Our strategy is to create value for shareholders and society in a sustainable way by developing, building, operating and investing in the electricity infrastructure and businesses needed in the transition to net zero.

Recommended Stories

Before you consider SSE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SSE wasn't on the list.

While SSE currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.