St. James's Place (LON:STJ - Get Free Report) had its price objective upped by Deutsche Bank Aktiengesellschaft from GBX 1,800 to GBX 1,900 in a research report issued on Thursday,Digital Look reports. The brokerage currently has a "buy" rating on the stock. Deutsche Bank Aktiengesellschaft's target price suggests a potential upside of 47.17% from the stock's previous close.

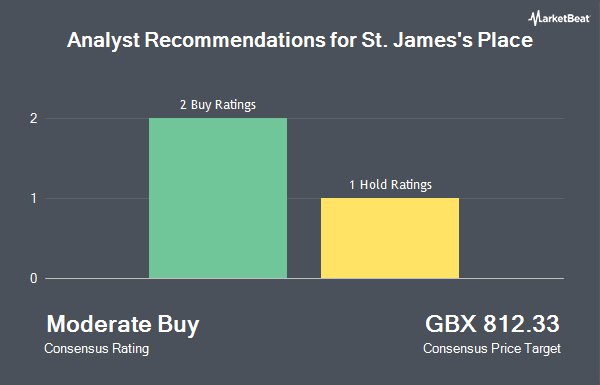

Other research analysts also recently issued reports about the stock. JPMorgan Chase & Co. raised their price objective on shares of St. James's Place from GBX 1,410 to GBX 1,550 and gave the stock an "overweight" rating in a research report on Thursday, August 7th. Citigroup raised their price objective on shares of St. James's Place from GBX 1,210 to GBX 1,400 and gave the stock a "buy" rating in a research report on Thursday, July 10th. Royal Bank Of Canada raised their price objective on shares of St. James's Place from GBX 1,025 to GBX 1,075 and gave the stock a "sector perform" rating in a research report on Monday, July 14th. Finally, Berenberg Bank raised their price objective on shares of St. James's Place from GBX 1,300 to GBX 1,650 and gave the stock a "buy" rating in a research report on Monday, August 11th. Four analysts have rated the stock with a Buy rating and one has given a Hold rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of GBX 1,515.

Read Our Latest Research Report on STJ

St. James's Place Trading Up 0.6%

LON STJ opened at GBX 1,291 on Thursday. The company has a debt-to-equity ratio of 55.10, a current ratio of 0.60 and a quick ratio of 3.85. The firm's fifty day moving average price is GBX 1,266.24 and its 200 day moving average price is GBX 1,124.66. The company has a market capitalization of £6.77 billion, a price-to-earnings ratio of 1,369.03, a price-to-earnings-growth ratio of 1.10 and a beta of 1.23. St. James's Place has a 12 month low of GBX 715.50 and a 12 month high of GBX 1,366.50.

St. James's Place (LON:STJ - Get Free Report) last posted its earnings results on Thursday, July 31st. The company reported GBX 52 EPS for the quarter. St. James's Place had a negative net margin of 0.02% and a negative return on equity of 0.63%. On average, sell-side analysts expect that St. James's Place will post 67.9947461 earnings per share for the current fiscal year.

About St. James's Place

(

Get Free Report)

We plan, grow and protect the financial futures of over one million clients across the UK by providing holistic advice-led wealth management, delivered exclusively by the Partnership, our group of more than 4,900 highly skilled advisers.

We offer an integrated client proposition, through which we provide financial advice, investment product wrappers such as pensions, investment bonds and ISAs, and offer our own range of investment funds and portfolios.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider St. James's Place, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and St. James's Place wasn't on the list.

While St. James's Place currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.