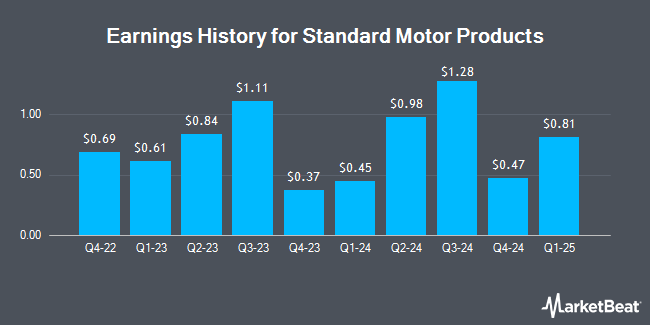

Standard Motor Products (NYSE:SMP - Get Free Report) is expected to be announcing its Q3 2025 results before the market opens on Wednesday, October 29th. Analysts expect the company to announce earnings of $1.20 per share and revenue of $503.33 million for the quarter. Investors are encouraged to explore the company's upcoming Q3 2025 earningoverview page for the latest details on the call scheduled for Wednesday, October 29, 2025 at 11:00 AM ET.

Standard Motor Products (NYSE:SMP - Get Free Report) last released its earnings results on Tuesday, August 5th. The auto parts company reported $1.29 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.97 by $0.32. Standard Motor Products had a net margin of 2.39% and a return on equity of 12.98%. The firm had revenue of $493.85 million during the quarter, compared to analyst estimates of $450.21 million. During the same period last year, the business earned $0.98 earnings per share. The business's revenue was up 26.7% on a year-over-year basis. On average, analysts expect Standard Motor Products to post $3 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Standard Motor Products Price Performance

SMP stock opened at $40.87 on Wednesday. The firm has a 50 day moving average price of $39.56 and a 200-day moving average price of $33.04. Standard Motor Products has a 52-week low of $21.38 and a 52-week high of $41.75. The firm has a market capitalization of $898.80 million, a price-to-earnings ratio of 23.22 and a beta of 0.67. The company has a debt-to-equity ratio of 0.86, a quick ratio of 0.87 and a current ratio of 2.16.

Standard Motor Products Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, September 2nd. Stockholders of record on Friday, August 15th were issued a dividend of $0.31 per share. This represents a $1.24 annualized dividend and a dividend yield of 3.0%. The ex-dividend date was Friday, August 15th. Standard Motor Products's dividend payout ratio (DPR) is presently 70.45%.

Hedge Funds Weigh In On Standard Motor Products

Hedge funds have recently added to or reduced their stakes in the company. Marshall Wace LLP grew its position in Standard Motor Products by 156.2% in the 2nd quarter. Marshall Wace LLP now owns 77,127 shares of the auto parts company's stock worth $2,369,000 after purchasing an additional 47,028 shares during the period. Public Sector Pension Investment Board grew its position in Standard Motor Products by 8.8% in the 2nd quarter. Public Sector Pension Investment Board now owns 71,154 shares of the auto parts company's stock worth $2,186,000 after purchasing an additional 5,730 shares during the period. Jane Street Group LLC grew its position in Standard Motor Products by 320.0% in the 1st quarter. Jane Street Group LLC now owns 64,037 shares of the auto parts company's stock worth $1,596,000 after purchasing an additional 48,790 shares during the period. Lazard Asset Management LLC grew its position in Standard Motor Products by 64,985.7% in the 2nd quarter. Lazard Asset Management LLC now owns 45,560 shares of the auto parts company's stock worth $1,399,000 after purchasing an additional 45,490 shares during the period. Finally, Squarepoint Ops LLC bought a new stake in Standard Motor Products in the 2nd quarter worth approximately $1,120,000. 81.26% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of equities analysts recently weighed in on SMP shares. Weiss Ratings restated a "hold (c)" rating on shares of Standard Motor Products in a report on Wednesday, October 8th. Wall Street Zen upgraded shares of Standard Motor Products from a "buy" rating to a "strong-buy" rating in a report on Saturday, July 26th. Finally, Zacks Research upgraded shares of Standard Motor Products from a "hold" rating to a "strong-buy" rating in a report on Monday, October 13th. One investment analyst has rated the stock with a Strong Buy rating and one has assigned a Hold rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Buy".

Check Out Our Latest Stock Analysis on Standard Motor Products

About Standard Motor Products

(

Get Free Report)

Standard Motor Products, Inc manufactures and distributes replacement automotive parts in the United States and internationally. The company operates through three segments: Vehicle Control, Temperature Control, and Engineered Solutions segments. The company provides components for the ignition, emissions, and fuel delivery systems, such as air injection and induction components, air management valves, regulators and solenoids, exhaust gas recirculation components, fuel injectors and related components, fuel valves, ignition coils, connectors and sockets, modules, pumps, relays and fuses, starting and charging system parts, and vapor and purge components.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Standard Motor Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Standard Motor Products wasn't on the list.

While Standard Motor Products currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.