Zacks Research upgraded shares of Starz Entertainment (NASDAQ:STRZ - Free Report) to a hold rating in a research report report published on Wednesday,Zacks.com reports.

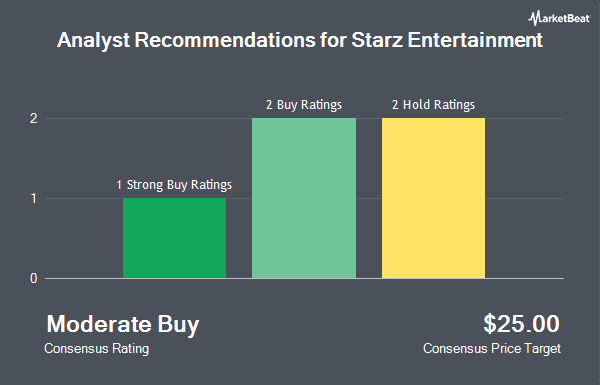

A number of other research analysts have also issued reports on the company. Benchmark started coverage on Starz Entertainment in a research report on Wednesday, July 9th. They set a "buy" rating and a $39.00 price target for the company. Wall Street Zen upgraded Starz Entertainment from a "sell" rating to a "hold" rating in a research note on Saturday, August 16th. Raymond James Financial reissued an "outperform" rating and set a $22.00 price objective (up previously from $19.00) on shares of Starz Entertainment in a research report on Friday, May 30th. Baird R W raised Starz Entertainment to a "hold" rating in a report on Friday, September 5th. Finally, Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating on shares of Starz Entertainment in a report on Friday, September 5th. One research analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating and six have given a Hold rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $22.00.

Get Our Latest Stock Analysis on Starz Entertainment

Starz Entertainment Stock Performance

NASDAQ:STRZ traded up $0.08 during trading hours on Wednesday, hitting $14.75. The company's stock had a trading volume of 4,031 shares, compared to its average volume of 208,254. Starz Entertainment has a 52-week low of $8.00 and a 52-week high of $22.98. The company has a 50-day moving average price of $14.20.

Starz Entertainment (NASDAQ:STRZ - Get Free Report) last released its quarterly earnings data on Thursday, August 14th. The company reported ($2.54) EPS for the quarter, missing analysts' consensus estimates of ($1.39) by ($1.15). The firm had revenue of $319.70 million during the quarter, compared to the consensus estimate of $328.70 million.

Insider Activity at Starz Entertainment

In other Starz Entertainment news, Director Harry Sloan acquired 8,100 shares of the business's stock in a transaction on Thursday, August 21st. The shares were acquired at an average price of $12.98 per share, for a total transaction of $105,138.00. Following the completion of the acquisition, the director owned 42,260 shares in the company, valued at $548,534.80. This trade represents a 23.71% increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders have bought 15,796 shares of company stock worth $201,896 over the last ninety days.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in STRZ. Liberty 77 Capital L.P. purchased a new position in Starz Entertainment during the second quarter valued at $28,987,000. Geode Capital Management LLC purchased a new stake in shares of Starz Entertainment in the 2nd quarter worth approximately $5,076,000. Jefferies Financial Group Inc. bought a new position in shares of Starz Entertainment during the 2nd quarter worth approximately $4,470,000. Marshall Wace LLP acquired a new position in Starz Entertainment during the 2nd quarter valued at approximately $2,212,000. Finally, Honeycomb Asset Management LP acquired a new stake in shares of Starz Entertainment in the second quarter worth $1,607,000.

Starz Entertainment Company Profile

(

Get Free Report)

Starz is a premium cable and streaming network owned by Starz Entertainment, which was formerly a part of Lionsgate. Starz had about 20 million subscribers in the U.S. and Canada as of Dec. 31, 2024. The company's franchises include “Outlander” and “Power."

Featured Stories

Before you consider Starz Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Starz Entertainment wasn't on the list.

While Starz Entertainment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.