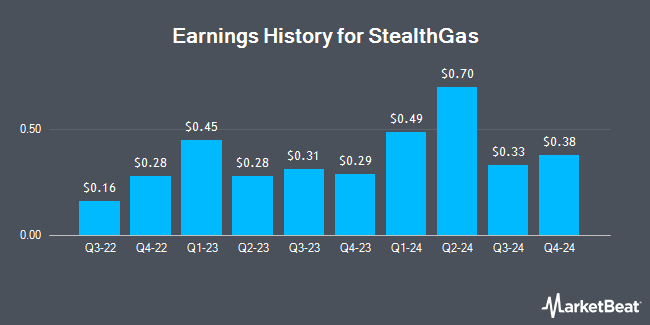

StealthGas (NASDAQ:GASS - Get Free Report) announced its quarterly earnings data on Monday. The shipping company reported $0.55 earnings per share for the quarter, Zacks reports. StealthGas had a return on equity of 10.79% and a net margin of 39.49%.

StealthGas Trading Up 9.0%

NASDAQ:GASS opened at $7.89 on Monday. The company has a quick ratio of 1.83, a current ratio of 1.90 and a debt-to-equity ratio of 0.05. The business's 50 day moving average is $6.72 and its two-hundred day moving average is $5.98. StealthGas has a 52 week low of $4.82 and a 52 week high of $7.55. The company has a market cap of $291.77 million, a PE ratio of 4.36 and a beta of 0.39.

Analysts Set New Price Targets

Separately, Wall Street Zen lowered StealthGas from a "buy" rating to a "hold" rating in a research note on Friday, May 30th.

View Our Latest Report on GASS

Institutional Trading of StealthGas

A number of institutional investors and hedge funds have recently made changes to their positions in GASS. Bank of America Corp DE increased its position in shares of StealthGas by 701.2% during the 4th quarter. Bank of America Corp DE now owns 10,263 shares of the shipping company's stock valued at $58,000 after purchasing an additional 8,982 shares during the period. Jump Financial LLC raised its position in shares of StealthGas by 249.2% during the second quarter. Jump Financial LLC now owns 38,651 shares of the shipping company's stock worth $248,000 after purchasing an additional 27,583 shares during the period. Finally, Jane Street Group LLC acquired a new stake in shares of StealthGas during the second quarter worth $91,000. 66.32% of the stock is currently owned by institutional investors and hedge funds.

StealthGas Company Profile

(

Get Free Report)

StealthGas Inc, together with its subsidiaries, provides seaborne transportation services to liquefied petroleum gas (LPG) producers and users worldwide. The company's carriers carry various petroleum gas products in liquefied form, including propane, butane, butadiene, isopropane, propylene, and vinyl chloride monomer, as well as ammonia; refined petroleum products, such as gasoline, diesel, fuel oil, and jet fuel; and edible oils and chemicals.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider StealthGas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StealthGas wasn't on the list.

While StealthGas currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.