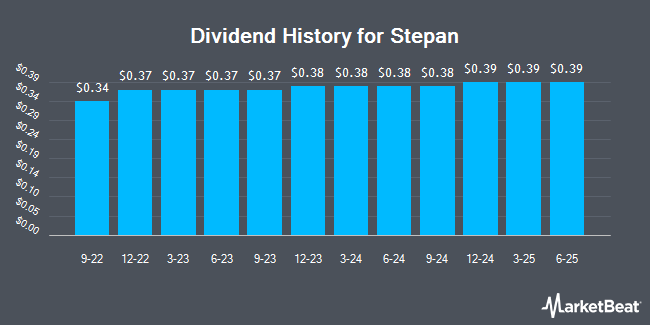

Stepan Company (NYSE:SCL - Get Free Report) announced a quarterly dividend on Wednesday, July 30th, RTT News reports. Investors of record on Friday, August 29th will be given a dividend of 0.385 per share by the basic materials company on Monday, September 15th. This represents a c) dividend on an annualized basis and a yield of 3.1%. The ex-dividend date is Friday, August 29th.

Stepan has a dividend payout ratio of 37.2% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Stepan to earn $4.79 per share next year, which means the company should continue to be able to cover its $1.54 annual dividend with an expected future payout ratio of 32.2%.

Stepan Stock Performance

SCL stock traded down $0.95 during midday trading on Friday, reaching $49.82. 168,493 shares of the company were exchanged, compared to its average volume of 107,140. Stepan has a one year low of $44.23 and a one year high of $82.08. The firm has a market capitalization of $1.12 billion, a price-to-earnings ratio of 19.61 and a beta of 0.98. The business has a 50-day moving average price of $55.80 and a two-hundred day moving average price of $56.29. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.35 and a quick ratio of 0.79.

Stepan (NYSE:SCL - Get Free Report) last announced its quarterly earnings results on Wednesday, July 30th. The basic materials company reported $0.52 EPS for the quarter, missing analysts' consensus estimates of $0.92 by ($0.40). The company had revenue of $594.69 million during the quarter, compared to analyst estimates of $598.25 million. Stepan had a net margin of 2.57% and a return on equity of 4.78%. The firm's quarterly revenue was up 6.9% on a year-over-year basis. During the same quarter last year, the company posted $0.41 EPS. Equities research analysts forecast that Stepan will post 3.55 EPS for the current year.

Analyst Ratings Changes

Separately, Wall Street Zen lowered Stepan from a "buy" rating to a "hold" rating in a research note on Saturday.

View Our Latest Research Report on SCL

About Stepan

(

Get Free Report)

Stepan Company, together with its subsidiaries, produces and sells specialty and intermediate chemicals to other manufacturers for use in various end products worldwide. It operates through three segments: Surfactants, Polymers, and Specialty Products. The Surfactants segment offers surfactants that are used in consumer and industrial cleaning and disinfection products, including detergents for washing clothes, dishes, carpets, and floors and walls, as well as shampoos and body washes; and other applications, such as fabric softeners, germicidal quaternary compounds, disinfectants, and lubricating ingredients.

Featured Articles

Before you consider Stepan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stepan wasn't on the list.

While Stepan currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.