Stephens reaffirmed their overweight rating on shares of IDEAYA Biosciences (NASDAQ:IDYA - Free Report) in a research note released on Tuesday morning,Benzinga reports. They currently have a $45.00 target price on the stock.

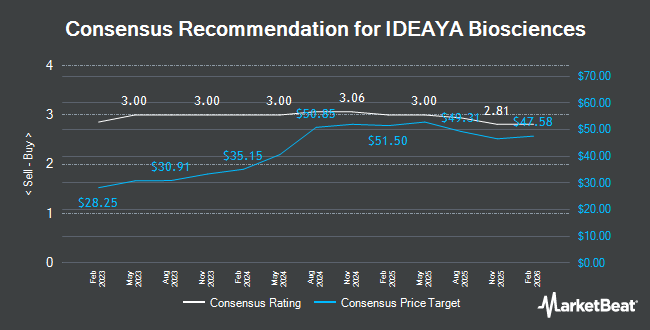

A number of other equities research analysts have also recently issued reports on IDYA. The Goldman Sachs Group upgraded IDEAYA Biosciences to a "hold" rating and set a $25.00 price objective for the company in a report on Thursday, July 10th. JPMorgan Chase & Co. boosted their price objective on IDEAYA Biosciences from $72.00 to $74.00 and gave the stock an "overweight" rating in a report on Wednesday, September 3rd. Wells Fargo & Company assumed coverage on IDEAYA Biosciences in a report on Thursday, June 26th. They set an "overweight" rating and a $44.00 price objective for the company. Barclays assumed coverage on IDEAYA Biosciences in a research note on Thursday, September 4th. They issued an "overweight" rating and a $40.00 price target for the company. Finally, Royal Bank Of Canada upgraded IDEAYA Biosciences from an "outperform" rating to a "moderate buy" rating and cut their price target for the company from $57.00 to $30.00 in a research note on Wednesday, July 9th. Thirteen equities research analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $42.85.

View Our Latest Stock Report on IDYA

IDEAYA Biosciences Price Performance

NASDAQ IDYA traded down $0.32 during trading on Tuesday, reaching $24.61. 1,047,343 shares of the company's stock were exchanged, compared to its average volume of 1,194,808. IDEAYA Biosciences has a fifty-two week low of $13.45 and a fifty-two week high of $37.80. The stock has a market capitalization of $2.16 billion, a P/E ratio of -6.49 and a beta of 0.12. The business has a 50 day moving average price of $23.94 and a 200-day moving average price of $20.75.

IDEAYA Biosciences (NASDAQ:IDYA - Get Free Report) last issued its quarterly earnings data on Tuesday, August 5th. The company reported ($0.88) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.85) by ($0.03). The firm had revenue of $6.00 million during the quarter, compared to the consensus estimate of $3.48 million. During the same period in the previous year, the company posted ($0.68) EPS. The firm's revenue for the quarter was up NaN% on a year-over-year basis. On average, analysts forecast that IDEAYA Biosciences will post -3.07 earnings per share for the current year.

Institutional Investors Weigh In On IDEAYA Biosciences

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. CWM LLC lifted its stake in IDEAYA Biosciences by 325.7% during the first quarter. CWM LLC now owns 2,371 shares of the company's stock worth $39,000 after purchasing an additional 1,814 shares during the last quarter. PNC Financial Services Group Inc. lifted its stake in IDEAYA Biosciences by 180.2% during the first quarter. PNC Financial Services Group Inc. now owns 2,404 shares of the company's stock worth $39,000 after purchasing an additional 1,546 shares during the last quarter. GF Fund Management CO. LTD. bought a new stake in IDEAYA Biosciences during the fourth quarter worth $47,000. Signaturefd LLC lifted its stake in IDEAYA Biosciences by 374.8% during the first quarter. Signaturefd LLC now owns 2,877 shares of the company's stock worth $47,000 after purchasing an additional 2,271 shares during the last quarter. Finally, Elevation Point Wealth Partners LLC bought a new stake in IDEAYA Biosciences during the second quarter worth $61,000. 98.29% of the stock is currently owned by institutional investors.

About IDEAYA Biosciences

(

Get Free Report)

IDEAYA Biosciences, Inc, a synthetic lethality-focused precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States. The company's products in development include IDE196, a protein kinase C inhibitor that is in Phase 2/3 clinical trials for genetically defined cancers having GNAQ or GNA11 gene mutations; IDE397, a methionine adenosyltransferase 2a inhibitor that is in Phase 1/2 clinical trials for patients with solid tumors having methylthioadenosine phosphorylase gene deletions, such as non-small cell lung, bladder, gastric, and esophageal cancers; IDE161, a poly ADP-ribose glycohydrolase inhibitor that is in Phase 1 clinical trial to treat tumors with homologous recombination deficiency (HRD), and other genetic or molecular signatures; GSK101, a Pol Theta Helicase inhibitor that is in Phase 1 clinical trial for the treatment of tumors with BRCA or other homologous recombination, and HRD mutations; and Werner Helicase inhibitors for tumors with high microsatellite instability.

Read More

Before you consider IDEAYA Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEAYA Biosciences wasn't on the list.

While IDEAYA Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.