RxSight (NASDAQ:RXST - Get Free Report) had its target price reduced by stock analysts at Stifel Nicolaus from $9.00 to $8.00 in a report released on Friday,Benzinga reports. The brokerage presently has a "hold" rating on the stock. Stifel Nicolaus' target price suggests a potential upside of 8.40% from the stock's current price.

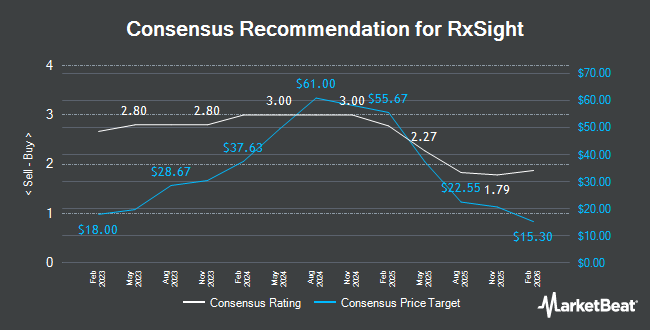

A number of other equities research analysts also recently issued reports on RXST. Morgan Stanley downgraded shares of RxSight from an "overweight" rating to an "equal weight" rating and cut their price objective for the company from $20.00 to $9.00 in a research report on Tuesday, July 15th. Needham & Company LLC dropped their target price on shares of RxSight from $22.00 to $11.00 and set a "buy" rating for the company in a report on Friday. Wells Fargo & Company downgraded RxSight from an "overweight" rating to an "equal weight" rating and decreased their target price for the company from $25.00 to $9.00 in a research note on Wednesday, July 9th. Wall Street Zen cut shares of RxSight from a "hold" rating to a "sell" rating in a research note on Saturday, July 12th. Finally, Oppenheimer downgraded RxSight from an "outperform" rating to a "market perform" rating in a research report on Wednesday, July 9th. Three analysts have rated the stock with a sell rating, eight have given a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $10.89.

Check Out Our Latest Analysis on RXST

RxSight Stock Down 5.3%

Shares of NASDAQ RXST traded down $0.41 during mid-day trading on Friday, reaching $7.38. 701,309 shares of the company were exchanged, compared to its average volume of 1,017,836. The stock has a market capitalization of $299.90 million, a PE ratio of -10.92 and a beta of 1.16. RxSight has a 52 week low of $6.32 and a 52 week high of $58.23. The company's 50 day moving average price is $11.25 and its 200 day moving average price is $18.65.

RxSight (NASDAQ:RXST - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The company reported ($0.29) EPS for the quarter, missing the consensus estimate of ($0.04) by ($0.25). RxSight had a negative net margin of 17.90% and a negative return on equity of 9.54%. The firm had revenue of $33.64 million for the quarter, compared to analysts' expectations of $39.78 million. During the same period in the prior year, the business posted ($0.16) EPS. The business's quarterly revenue was down 3.7% compared to the same quarter last year. On average, sell-side analysts predict that RxSight will post -0.7 earnings per share for the current year.

Hedge Funds Weigh In On RxSight

A number of large investors have recently added to or reduced their stakes in the stock. State of Wyoming purchased a new position in RxSight during the fourth quarter worth approximately $37,000. Coppell Advisory Solutions LLC increased its stake in shares of RxSight by 108.9% in the 4th quarter. Coppell Advisory Solutions LLC now owns 1,289 shares of the company's stock worth $44,000 after acquiring an additional 672 shares during the last quarter. Bessemer Group Inc. purchased a new position in shares of RxSight during the 2nd quarter worth $33,000. Russell Investments Group Ltd. boosted its position in shares of RxSight by 161.2% during the 1st quarter. Russell Investments Group Ltd. now owns 4,091 shares of the company's stock valued at $103,000 after acquiring an additional 2,525 shares during the last quarter. Finally, CWM LLC grew its holdings in shares of RxSight by 614.1% in the second quarter. CWM LLC now owns 4,520 shares of the company's stock valued at $59,000 after purchasing an additional 3,887 shares during the period. 78.78% of the stock is currently owned by institutional investors and hedge funds.

About RxSight

(

Get Free Report)

RxSight, Inc, a commercial-stage medical device company, engages in the research and development, manufacture, and sale of light adjustable intraocular lenses (LAL) used in cataract surgery in the United States and internationally. It offers RxSight system that enables doctors to customize and enhance the visual acuity for patients after cataract surgery.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider RxSight, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RxSight wasn't on the list.

While RxSight currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.