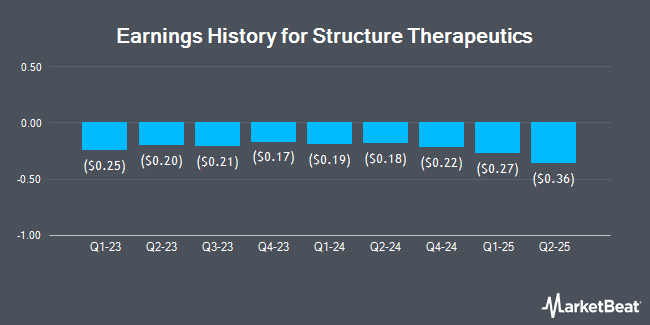

Structure Therapeutics (NASDAQ:GPCR - Get Free Report) issued its quarterly earnings data on Wednesday, August 6th. The company reported ($0.36) EPS for the quarter, missing analysts' consensus estimates of ($0.28) by ($0.08), Zacks reports.

Structure Therapeutics Stock Performance

Shares of NASDAQ:GPCR traded up $0.41 on Wednesday, hitting $19.15. The company's stock had a trading volume of 111,916 shares, compared to its average volume of 873,516. Structure Therapeutics has a 12 month low of $13.22 and a 12 month high of $45.37. The company has a market capitalization of $1.10 billion, a price-to-earnings ratio of -18.24 and a beta of -1.89. The stock's 50-day moving average is $19.63 and its two-hundred day moving average is $21.67.

Institutional Trading of Structure Therapeutics

A hedge fund recently raised its stake in Structure Therapeutics stock. Geode Capital Management LLC increased its position in Structure Therapeutics Inc. Sponsored ADR (NASDAQ:GPCR - Free Report) by 18.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 54,181 shares of the company's stock after buying an additional 8,444 shares during the quarter. Geode Capital Management LLC owned about 0.09% of Structure Therapeutics worth $1,124,000 at the end of the most recent reporting period. Institutional investors and hedge funds own 91.78% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts recently commented on GPCR shares. JMP Securities lowered their price objective on Structure Therapeutics from $89.00 to $87.00 and set a "market outperform" rating for the company in a research note on Thursday, August 7th. Citigroup started coverage on Structure Therapeutics in a research note on Friday, May 2nd. They set a "buy" rating and a $60.00 price objective for the company. Cantor Fitzgerald restated an "overweight" rating and set a $65.00 price objective on shares of Structure Therapeutics in a research note on Monday, June 23rd. HC Wainwright lowered their price objective on Structure Therapeutics from $75.00 to $60.00 and set a "buy" rating for the company in a research note on Thursday, August 7th. Finally, Guggenheim lowered their price objective on Structure Therapeutics from $92.00 to $90.00 and set a "buy" rating for the company in a research note on Thursday, August 7th. Eight research analysts have rated the stock with a buy rating, According to MarketBeat.com, the company presently has a consensus rating of "Buy" and a consensus price target of $75.71.

Get Our Latest Report on GPCR

About Structure Therapeutics

(

Get Free Report)

Structure Therapeutics Inc, a clinical stage global biopharmaceutical company, develops and delivers novel oral therapeutics to treat a range of chronic diseases with unmet medical needs. The company's lead product candidate is GSBR-1290, an oral and biased small molecule agonist of glucagon-like-peptide-1 receptor, a validated G-protein-coupled receptors (GPCRs) drug target for type-2 diabetes mellitus and obesity.

See Also

Before you consider Structure Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Structure Therapeutics wasn't on the list.

While Structure Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.