Sun Country Airlines (NASDAQ:SNCY - Get Free Report) was upgraded by investment analysts at Wall Street Zen from a "buy" rating to a "strong-buy" rating in a research report issued on Friday.

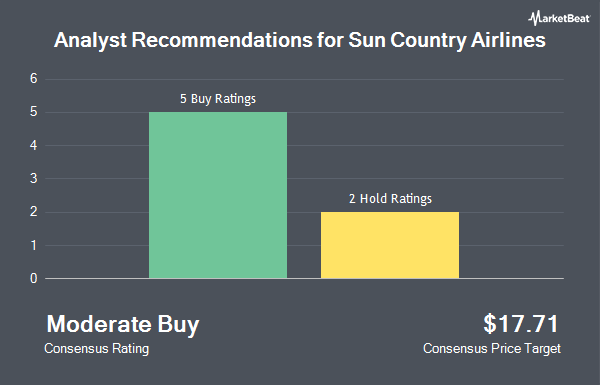

Other research analysts also recently issued research reports about the company. Evercore ISI decreased their price objective on Sun Country Airlines from $20.00 to $19.00 and set an "outperform" rating on the stock in a report on Monday, August 4th. Morgan Stanley decreased their price objective on Sun Country Airlines from $21.00 to $20.00 and set an "overweight" rating on the stock in a report on Monday, August 4th. Finally, Susquehanna reiterated a "neutral" rating and issued a $11.00 price objective (down previously from $12.00) on shares of Sun Country Airlines in a report on Tuesday, August 5th. Six research analysts have rated the stock with a Buy rating and two have given a Hold rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $17.38.

Get Our Latest Research Report on Sun Country Airlines

Sun Country Airlines Price Performance

SNCY stock traded up $0.54 during mid-day trading on Friday, hitting $13.65. 1,052,213 shares of the stock were exchanged, compared to its average volume of 737,006. The stock has a market capitalization of $727.82 million, a price-to-earnings ratio of 12.88, a PEG ratio of 0.31 and a beta of 1.62. The business has a fifty day moving average price of $12.34 and a 200 day moving average price of $12.00. The company has a debt-to-equity ratio of 0.72, a current ratio of 0.63 and a quick ratio of 0.59. Sun Country Airlines has a 12 month low of $8.10 and a 12 month high of $18.59.

Sun Country Airlines (NASDAQ:SNCY - Get Free Report) last released its quarterly earnings data on Thursday, July 31st. The company reported $0.14 EPS for the quarter, topping the consensus estimate of $0.13 by $0.01. The firm had revenue of $263.62 million for the quarter, compared to the consensus estimate of $256.04 million. Sun Country Airlines had a return on equity of 10.53% and a net margin of 5.35%.The company's quarterly revenue was up 3.6% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.06 earnings per share. Sun Country Airlines has set its Q3 2025 guidance at EPS. On average, sell-side analysts anticipate that Sun Country Airlines will post 1.92 EPS for the current year.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the business. EverSource Wealth Advisors LLC raised its position in Sun Country Airlines by 1,728.8% during the 2nd quarter. EverSource Wealth Advisors LLC now owns 2,158 shares of the company's stock valued at $25,000 after purchasing an additional 2,040 shares during the last quarter. Nisa Investment Advisors LLC raised its position in Sun Country Airlines by 1,556.8% during the 2nd quarter. Nisa Investment Advisors LLC now owns 4,490 shares of the company's stock valued at $53,000 after purchasing an additional 4,219 shares during the last quarter. GAMMA Investing LLC grew its holdings in shares of Sun Country Airlines by 493.1% during the 2nd quarter. GAMMA Investing LLC now owns 4,757 shares of the company's stock worth $56,000 after acquiring an additional 3,955 shares during the period. Canada Pension Plan Investment Board purchased a new position in shares of Sun Country Airlines during the 2nd quarter worth approximately $59,000. Finally, BNP Paribas Financial Markets purchased a new position in shares of Sun Country Airlines during the 4th quarter worth approximately $74,000.

Sun Country Airlines Company Profile

(

Get Free Report)

Sun Country Airlines Holdings, Inc, an air carrier company, operates scheduled passenger, air cargo, charter air transportation, and related services in the United States, Latin America, and internationally. It operates through two segments, Passenger and Cargo. The company also provides crew, maintenance, and insurance services through ad hoc, repeat, short-term, and long-term service contracts; and loyalty program rewards.

Featured Stories

Before you consider Sun Country Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Country Airlines wasn't on the list.

While Sun Country Airlines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.