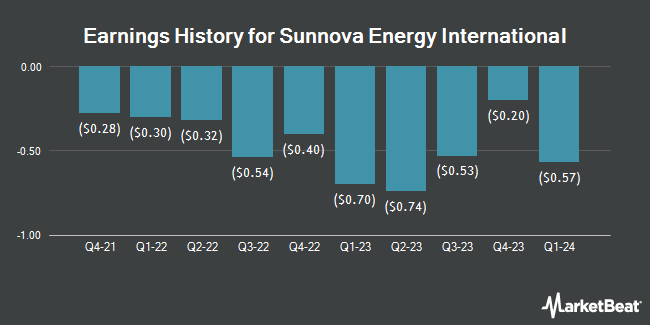

Sunnova Energy International (NYSE:NOVA - Get Free Report) is anticipated to post its quarterly earnings results before the market opens on Monday, March 3rd. Analysts expect Sunnova Energy International to post earnings of ($0.79) per share and revenue of $235.85 million for the quarter. Individual that are interested in participating in the company's earnings conference call can do so using this link.

Sunnova Energy International Trading Down 0.9 %

Shares of NOVA traded down $0.02 during midday trading on Thursday, hitting $1.73. The stock had a trading volume of 6,328,813 shares, compared to its average volume of 9,694,345. The business has a 50-day simple moving average of $2.96 and a two-hundred day simple moving average of $5.72. The firm has a market cap of $215.54 million, a P/E ratio of -0.51 and a beta of 2.28. The company has a current ratio of 0.86, a quick ratio of 0.86 and a debt-to-equity ratio of 3.26. Sunnova Energy International has a fifty-two week low of $1.70 and a fifty-two week high of $13.00.

Analyst Ratings Changes

NOVA has been the topic of several recent research reports. Susquehanna lowered shares of Sunnova Energy International from a "positive" rating to a "neutral" rating and cut their price objective for the company from $14.00 to $4.50 in a research report on Friday, January 10th. BMO Capital Markets reissued a "market perform" rating and set a $8.00 target price (down from $10.00) on shares of Sunnova Energy International in a research report on Friday, November 1st. Royal Bank of Canada downgraded Sunnova Energy International from an "outperform" rating to a "sector perform" rating in a research note on Monday, December 9th. Wells Fargo & Company reduced their target price on Sunnova Energy International from $8.00 to $4.00 and set an "equal weight" rating for the company in a report on Wednesday, January 8th. Finally, TD Cowen assumed coverage on shares of Sunnova Energy International in a report on Thursday, December 19th. They set a "hold" rating and a $5.00 price target for the company. One analyst has rated the stock with a sell rating, twelve have issued a hold rating and eleven have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $9.03.

View Our Latest Analysis on NOVA

About Sunnova Energy International

(

Get Free Report)

Sunnova Energy International Inc engages in the provision of energy as a service in the United States. The company offers electricity, as well as offers operations and maintenance, monitoring, repairs and replacements, equipment upgrades, on-site power optimization, and solar energy system and energy storage system diagnostics services.

Featured Stories

Before you consider Sunnova Energy International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunnova Energy International wasn't on the list.

While Sunnova Energy International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.