Susquehanna Fundamental Investments LLC bought a new position in shares of Universal Health Realty Income Trust (NYSE:UHT - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund bought 13,849 shares of the real estate investment trust's stock, valued at approximately $515,000. Susquehanna Fundamental Investments LLC owned about 0.10% of Universal Health Realty Income Trust at the end of the most recent reporting period.

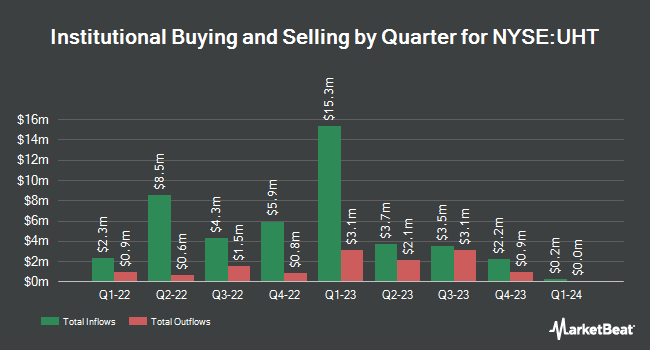

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Bank of New York Mellon Corp grew its stake in Universal Health Realty Income Trust by 42.5% during the fourth quarter. Bank of New York Mellon Corp now owns 336,183 shares of the real estate investment trust's stock worth $12,509,000 after purchasing an additional 100,325 shares during the period. JPMorgan Chase & Co. boosted its position in Universal Health Realty Income Trust by 64.9% in the third quarter. JPMorgan Chase & Co. now owns 81,834 shares of the real estate investment trust's stock worth $3,744,000 after purchasing an additional 32,216 shares during the last quarter. Raymond James Financial Inc. purchased a new position in Universal Health Realty Income Trust in the fourth quarter valued at about $691,000. Barclays PLC increased its position in Universal Health Realty Income Trust by 392.1% in the third quarter. Barclays PLC now owns 22,852 shares of the real estate investment trust's stock worth $1,045,000 after buying an additional 18,208 shares during the last quarter. Finally, Renaissance Technologies LLC lifted its holdings in Universal Health Realty Income Trust by 4.8% during the fourth quarter. Renaissance Technologies LLC now owns 272,310 shares of the real estate investment trust's stock valued at $10,133,000 after purchasing an additional 12,500 shares during the last quarter. 64.66% of the stock is currently owned by institutional investors and hedge funds.

Universal Health Realty Income Trust Stock Performance

Shares of NYSE:UHT traded up $0.01 during midday trading on Friday, reaching $39.05. 10,293 shares of the company traded hands, compared to its average volume of 63,839. The firm's fifty day moving average price is $39.49 and its two-hundred day moving average price is $39.35. The company has a quick ratio of 6.65, a current ratio of 6.65 and a debt-to-equity ratio of 2.02. Universal Health Realty Income Trust has a 12 month low of $34.56 and a 12 month high of $47.30. The firm has a market capitalization of $540.88 million, a price-to-earnings ratio of 29.81 and a beta of 0.88.

Universal Health Realty Income Trust (NYSE:UHT - Get Free Report) last issued its earnings results on Monday, April 28th. The real estate investment trust reported $0.86 earnings per share (EPS) for the quarter. Universal Health Realty Income Trust had a net margin of 18.41% and a return on equity of 9.44%. The firm had revenue of $24.55 million for the quarter.

Universal Health Realty Income Trust Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Monday, March 24th were given a dividend of $0.735 per share. The ex-dividend date was Monday, March 24th. This represents a $2.94 annualized dividend and a dividend yield of 7.53%. Universal Health Realty Income Trust's dividend payout ratio is presently 217.78%.

About Universal Health Realty Income Trust

(

Free Report)

Universal Health Realty Income Trust, a real estate investment trust, invests in healthcare and human-service related facilities including acute care hospitals, behavioral health care hospitals, specialty facilities, medical/office buildings, free-standing emergency departments and childcare centers.

Featured Articles

Before you consider Universal Health Realty Income Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Health Realty Income Trust wasn't on the list.

While Universal Health Realty Income Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.