TechnipFMC (NYSE:FTI - Get Free Report) had its price objective lifted by equities researchers at Susquehanna from $40.00 to $45.00 in a research report issued on Friday,Benzinga reports. The brokerage currently has a "positive" rating on the oil and gas company's stock. Susquehanna's target price indicates a potential upside of 19.32% from the company's current price.

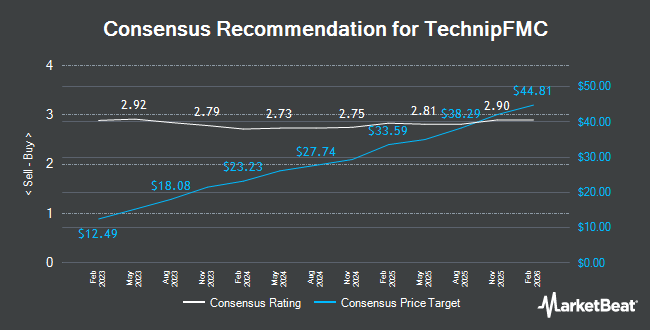

Other research analysts have also issued research reports about the stock. Barclays raised their price objective on shares of TechnipFMC from $43.00 to $45.00 and gave the company an "overweight" rating in a research note on Friday, April 25th. Wall Street Zen lowered shares of TechnipFMC from a "buy" rating to a "hold" rating in a research note on Friday, June 27th. Citigroup reissued a "buy" rating and set a $41.00 target price (up previously from $35.00) on shares of TechnipFMC in a research note on Thursday, July 10th. BTIG Research downgraded shares of TechnipFMC from a "buy" rating to a "neutral" rating in a report on Monday, July 14th. Finally, Royal Bank Of Canada restated an "outperform" rating and issued a $37.00 price target on shares of TechnipFMC in a research report on Monday, April 28th. Four research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, TechnipFMC presently has a consensus rating of "Moderate Buy" and a consensus target price of $37.69.

Get Our Latest Research Report on FTI

TechnipFMC Stock Performance

Shares of FTI stock opened at $37.71 on Friday. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.84 and a current ratio of 1.07. TechnipFMC has a one year low of $22.11 and a one year high of $37.69. The company's 50-day simple moving average is $33.25 and its 200-day simple moving average is $30.54. The stock has a market capitalization of $15.81 billion, a price-to-earnings ratio of 19.83, a PEG ratio of 1.13 and a beta of 1.07.

TechnipFMC (NYSE:FTI - Get Free Report) last announced its quarterly earnings results on Thursday, July 24th. The oil and gas company reported $0.68 EPS for the quarter, beating the consensus estimate of $0.57 by $0.11. TechnipFMC had a net margin of 8.93% and a return on equity of 27.01%. The company had revenue of $2.53 billion for the quarter, compared to analyst estimates of $2.49 billion. During the same quarter last year, the business earned $0.43 earnings per share. TechnipFMC's revenue was up 9.0% compared to the same quarter last year. Equities analysts anticipate that TechnipFMC will post 1.63 earnings per share for the current fiscal year.

Institutional Trading of TechnipFMC

Several hedge funds and other institutional investors have recently modified their holdings of FTI. AQR Capital Management LLC raised its position in TechnipFMC by 111.4% during the first quarter. AQR Capital Management LLC now owns 8,735,697 shares of the oil and gas company's stock valued at $273,078,000 after purchasing an additional 4,602,939 shares in the last quarter. Ameriprise Financial Inc. lifted its holdings in TechnipFMC by 31.5% during the 4th quarter. Ameriprise Financial Inc. now owns 16,538,230 shares of the oil and gas company's stock worth $478,620,000 after buying an additional 3,962,315 shares during the period. Norges Bank acquired a new position in TechnipFMC during the 4th quarter worth about $96,808,000. Anomaly Capital Management LP lifted its holdings in TechnipFMC by 46.5% during the 4th quarter. Anomaly Capital Management LP now owns 7,266,580 shares of the oil and gas company's stock worth $210,295,000 after buying an additional 2,306,342 shares during the period. Finally, Boston Partners lifted its holdings in TechnipFMC by 648.3% during the 1st quarter. Boston Partners now owns 2,630,793 shares of the oil and gas company's stock worth $83,281,000 after buying an additional 2,279,247 shares during the period. Institutional investors own 96.58% of the company's stock.

About TechnipFMC

(

Get Free Report)

TechnipFMC plc engages in the energy projects, technologies, and systems and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally. It operates through two segments: Subsea and Surface Technologies. The Subsea segment engages in the design, engineering, procurement, manufacturing, fabrication, installation, and life of field services for subsea systems, subsea field infrastructure, and subsea pipe systems used in oil and gas production and transportation.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TechnipFMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TechnipFMC wasn't on the list.

While TechnipFMC currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.