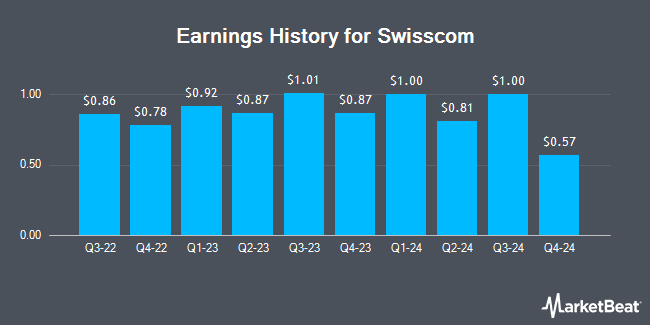

Swisscom (OTCMKTS:SCMWY - Get Free Report) posted its earnings results on Thursday, August 7th. The utilities provider reported $0.61 earnings per share for the quarter, missing analysts' consensus estimates of $0.88 by ($0.27), Zacks reports. Swisscom had a return on equity of 10.09% and a net margin of 9.29%. The business had revenue of $4.57 billion for the quarter, compared to the consensus estimate of $4.61 billion.

Swisscom Trading Down 0.4%

Shares of OTCMKTS:SCMWY traded down $0.26 during trading on Thursday, reaching $72.07. The stock had a trading volume of 7,161 shares, compared to its average volume of 13,579. The firm's fifty day moving average is $70.44 and its 200 day moving average is $64.80. The company has a debt-to-equity ratio of 0.99, a quick ratio of 0.85 and a current ratio of 0.85. Swisscom has a 52 week low of $54.66 and a 52 week high of $73.21. The stock has a market cap of $373.33 billion, a price-to-earnings ratio of 24.27 and a beta of 0.30.

Analyst Ratings Changes

Separately, Berenberg Bank raised shares of Swisscom to a "hold" rating in a report on Thursday, June 26th.

View Our Latest Stock Report on SCMWY

Swisscom Company Profile

(

Get Free Report)

Swisscom AG provides telecommunication services primarily in Switzerland, Italy, and internationally. It operates through three segments: Swisscom Switzerland, Fastweb, and Other Operating. The company offers mobile and fixed-network services, such as telephony, TV, broadband, and mobile offerings, as well as sells terminal equipment; and telecom and communications solutions for large corporations and small and medium-sized enterprises.

Featured Stories

Before you consider Swisscom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Swisscom wasn't on the list.

While Swisscom currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.