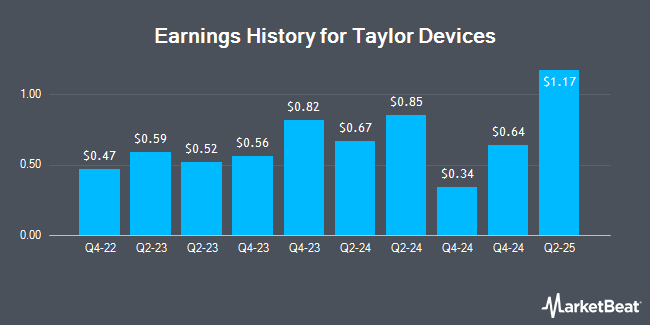

Taylor Devices (NASDAQ:TAYD - Get Free Report) announced its quarterly earnings data on Friday. The industrial products company reported $1.17 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.67 by $0.50, Zacks reports. The firm had revenue of $15.56 million for the quarter, compared to the consensus estimate of $13.73 million. Taylor Devices had a net margin of 20.33% and a return on equity of 16.40%.

Taylor Devices Price Performance

TAYD stock traded down $0.90 during mid-day trading on Wednesday, reaching $44.10. 5,118 shares of the company traded hands, compared to its average volume of 22,720. The company has a market capitalization of $138.92 million, a P/E ratio of 14.70 and a beta of 0.89. Taylor Devices has a 52-week low of $29.50 and a 52-week high of $64.50. The company has a fifty day moving average price of $43.62 and a 200-day moving average price of $36.94.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen upgraded shares of Taylor Devices from a "hold" rating to a "strong-buy" rating in a research report on Saturday.

View Our Latest Research Report on Taylor Devices

Institutional Trading of Taylor Devices

A number of hedge funds have recently made changes to their positions in the stock. Tower Research Capital LLC TRC lifted its position in Taylor Devices by 253.3% in the 2nd quarter. Tower Research Capital LLC TRC now owns 1,014 shares of the industrial products company's stock worth $44,000 after buying an additional 727 shares during the last quarter. Brevan Howard Capital Management LP bought a new stake in Taylor Devices in the 2nd quarter worth approximately $246,000. Bank of America Corp DE lifted its position in Taylor Devices by 16.3% in the 2nd quarter. Bank of America Corp DE now owns 2,153 shares of the industrial products company's stock worth $93,000 after buying an additional 301 shares during the last quarter. Ameriprise Financial Inc. bought a new stake in Taylor Devices in the 2nd quarter worth approximately $4,361,000. Finally, First Trust Advisors LP lifted its position in Taylor Devices by 4.1% in the 2nd quarter. First Trust Advisors LP now owns 10,127 shares of the industrial products company's stock worth $440,000 after buying an additional 399 shares during the last quarter. 17.62% of the stock is owned by institutional investors.

About Taylor Devices

(

Get Free Report)

Taylor Devices, Inc engages in design, development, manufacture, and marketing of shock absorption, rate control, and energy storage devices for use in machinery, equipment, and structures in the United States, Asia, and internationally. Its products include seismic dampers that are designed to mitigate the effects of earthquakes on structures; Fluidicshoks, which are compact shock absorbers primarily used in defense, aerospace, and commercial industries; and crane and industrial buffers, which are larger versions of the Fluidicshoks for industrial application on cranes and crane trolleys, truck docks, ladle and ingot cars, ore trolleys, and train car stops.

See Also

Before you consider Taylor Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taylor Devices wasn't on the list.

While Taylor Devices currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.