Wall Street Zen upgraded shares of TechnipFMC (NYSE:FTI - Free Report) from a hold rating to a buy rating in a report published on Saturday morning.

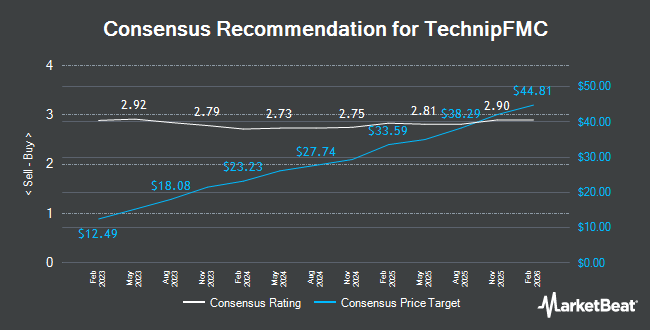

Other research analysts also recently issued research reports about the stock. Sanford C. Bernstein downgraded shares of TechnipFMC from a "strong-buy" rating to a "hold" rating and set a $32.00 price objective for the company. in a research report on Thursday, May 22nd. Susquehanna decreased their price objective on shares of TechnipFMC from $41.00 to $35.00 and set a "positive" rating for the company in a research report on Monday, April 14th. Barclays lifted their target price on shares of TechnipFMC from $43.00 to $45.00 and gave the stock an "overweight" rating in a report on Friday, April 25th. Royal Bank of Canada reaffirmed an "outperform" rating and set a $37.00 target price on shares of TechnipFMC in a report on Monday, April 28th. Finally, Piper Sandler lifted their target price on shares of TechnipFMC from $39.00 to $40.00 and gave the stock an "overweight" rating in a report on Friday, February 28th. Two equities research analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $36.46.

Read Our Latest Stock Report on TechnipFMC

TechnipFMC Stock Performance

Shares of FTI traded up $0.48 during midday trading on Friday, reaching $31.20. The stock had a trading volume of 3,439,081 shares, compared to its average volume of 4,026,175. The firm has a 50 day simple moving average of $28.49 and a 200-day simple moving average of $29.43. TechnipFMC has a one year low of $22.12 and a one year high of $33.45. The firm has a market cap of $13.08 billion, a PE ratio of 20.52 and a beta of 0.98. The company has a current ratio of 1.14, a quick ratio of 0.89 and a debt-to-equity ratio of 0.22.

TechnipFMC (NYSE:FTI - Get Free Report) last announced its quarterly earnings data on Thursday, April 24th. The oil and gas company reported $0.33 EPS for the quarter, missing analysts' consensus estimates of $0.36 by ($0.03). TechnipFMC had a net margin of 7.63% and a return on equity of 20.11%. The firm had revenue of $2.23 billion during the quarter, compared to the consensus estimate of $2.26 billion. During the same period last year, the business earned $0.22 EPS. The business's revenue was up 9.4% on a year-over-year basis. As a group, sell-side analysts anticipate that TechnipFMC will post 1.63 EPS for the current year.

TechnipFMC Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, June 4th. Shareholders of record on Tuesday, May 20th will be issued a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a yield of 0.64%. The ex-dividend date of this dividend is Tuesday, May 20th. TechnipFMC's dividend payout ratio is currently 10.53%.

Insider Activity

In other news, EVP Justin Rounce sold 42,178 shares of the business's stock in a transaction that occurred on Wednesday, March 12th. The shares were sold at an average price of $26.55, for a total value of $1,119,825.90. Following the completion of the transaction, the executive vice president now directly owns 140,207 shares in the company, valued at approximately $3,722,495.85. The trade was a 23.13% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CAO David Light sold 10,147 shares of the business's stock in a transaction that occurred on Tuesday, March 11th. The shares were sold at an average price of $24.90, for a total transaction of $252,660.30. Following the completion of the transaction, the chief accounting officer now owns 7,529 shares of the company's stock, valued at $187,472.10. The trade was a 57.41% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 61,706 shares of company stock worth $1,651,665. 1.80% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On TechnipFMC

Several hedge funds and other institutional investors have recently made changes to their positions in the company. Ballentine Partners LLC increased its position in TechnipFMC by 3.8% during the 4th quarter. Ballentine Partners LLC now owns 11,646 shares of the oil and gas company's stock worth $337,000 after purchasing an additional 423 shares in the last quarter. SG Americas Securities LLC increased its position in TechnipFMC by 23.8% during the 4th quarter. SG Americas Securities LLC now owns 18,929 shares of the oil and gas company's stock worth $548,000 after purchasing an additional 3,635 shares in the last quarter. Mutual Advisors LLC increased its position in TechnipFMC by 12.7% during the 4th quarter. Mutual Advisors LLC now owns 11,795 shares of the oil and gas company's stock worth $341,000 after purchasing an additional 1,325 shares in the last quarter. Impact Partnership Wealth LLC increased its position in TechnipFMC by 8.8% during the 4th quarter. Impact Partnership Wealth LLC now owns 8,967 shares of the oil and gas company's stock worth $260,000 after purchasing an additional 722 shares in the last quarter. Finally, Toth Financial Advisory Corp increased its position in TechnipFMC by 1,225.0% during the 4th quarter. Toth Financial Advisory Corp now owns 26,500 shares of the oil and gas company's stock worth $767,000 after purchasing an additional 24,500 shares in the last quarter. 96.58% of the stock is currently owned by institutional investors and hedge funds.

About TechnipFMC

(

Get Free Report)

TechnipFMC plc engages in the energy projects, technologies, and systems and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally. It operates through two segments: Subsea and Surface Technologies. The Subsea segment engages in the design, engineering, procurement, manufacturing, fabrication, installation, and life of field services for subsea systems, subsea field infrastructure, and subsea pipe systems used in oil and gas production and transportation.

Recommended Stories

Before you consider TechnipFMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TechnipFMC wasn't on the list.

While TechnipFMC currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report