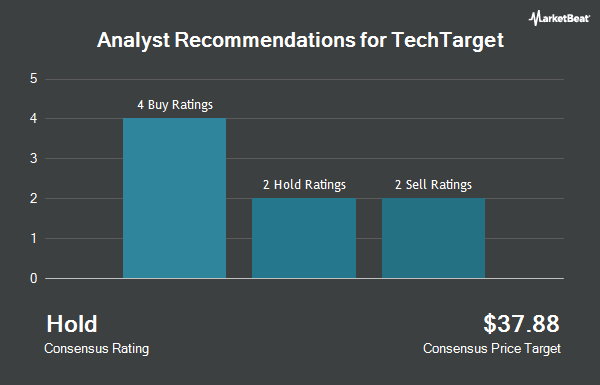

TechTarget, Inc. (NASDAQ:TTGT - Get Free Report) has earned a consensus recommendation of "Moderate Buy" from the six analysts that are covering the company, Marketbeat Ratings reports. One analyst has rated the stock with a sell recommendation, one has given a hold recommendation and four have assigned a buy recommendation to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $19.67.

Several analysts have commented on the stock. Wall Street Zen upgraded shares of TechTarget from a "sell" rating to a "hold" rating in a research note on Saturday, April 26th. Craig Hallum assumed coverage on shares of TechTarget in a research note on Monday, June 9th. They set a "buy" rating and a $12.00 price objective for the company. Lake Street Capital decreased their price objective on shares of TechTarget from $24.00 to $12.00 and set a "buy" rating for the company in a research note on Wednesday, April 16th. Needham & Company LLC decreased their price objective on shares of TechTarget from $25.00 to $15.00 and set a "buy" rating for the company in a research note on Thursday, June 5th. Finally, JPMorgan Chase & Co. cut shares of TechTarget from a "neutral" rating to an "underweight" rating and decreased their price objective for the company from $18.00 to $8.00 in a research note on Tuesday, June 10th.

Check Out Our Latest Analysis on TTGT

Institutional Investors Weigh In On TechTarget

Several institutional investors and hedge funds have recently added to or reduced their stakes in TTGT. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its holdings in TechTarget by 4.9% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 14,860 shares of the information services provider's stock valued at $295,000 after acquiring an additional 698 shares during the period. Balyasny Asset Management L.P. increased its position in shares of TechTarget by 3.5% in the fourth quarter. Balyasny Asset Management L.P. now owns 22,199 shares of the information services provider's stock valued at $440,000 after buying an additional 747 shares in the last quarter. State of Tennessee Department of Treasury increased its position in shares of TechTarget by 8.2% in the fourth quarter. State of Tennessee Department of Treasury now owns 12,074 shares of the information services provider's stock valued at $239,000 after buying an additional 910 shares in the last quarter. PNC Financial Services Group Inc. increased its position in shares of TechTarget by 18.7% in the first quarter. PNC Financial Services Group Inc. now owns 9,768 shares of the information services provider's stock valued at $145,000 after buying an additional 1,541 shares in the last quarter. Finally, Rhumbline Advisers raised its stake in TechTarget by 2.7% in the 4th quarter. Rhumbline Advisers now owns 74,980 shares of the information services provider's stock valued at $1,486,000 after purchasing an additional 1,994 shares during the last quarter. Hedge funds and other institutional investors own 93.52% of the company's stock.

TechTarget Stock Up 0.8%

Shares of TechTarget stock opened at $7.13 on Tuesday. TechTarget has a 52-week low of $6.80 and a 52-week high of $35.11. The firm's 50 day moving average price is $7.86 and its 200-day moving average price is $13.85. The company has a quick ratio of 10.49, a current ratio of 10.49 and a debt-to-equity ratio of 1.65. The company has a market cap of $208.45 million, a P/E ratio of -16.98, a PEG ratio of 113.92 and a beta of 1.05.

About TechTarget

(

Get Free ReportTechTarget, Inc, together with its subsidiaries, provides marketing and sales services that deliver business impact for business-to-business technology companies in North America and internationally. The company's service enables technology vendors to identify, reach, and influence corporate information technology (IT) decision-makers actively researching specific IT purchases; and customized marketing programs that integrate demand generation, brand advertising techniques, and content curation and creation.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TechTarget, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TechTarget wasn't on the list.

While TechTarget currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.