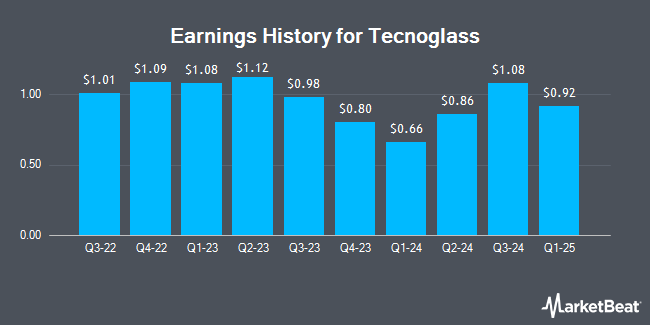

Tecnoglass (NASDAQ:TGLS - Get Free Report) issued its quarterly earnings data on Thursday, August 7th. The company reported $1.03 EPS for the quarter, beating the consensus estimate of $0.96 by $0.07, Briefing.com reports. Tecnoglass had a return on equity of 27.71% and a net margin of 17.82%. During the same period last year, the company earned $0.86 EPS. The business's quarterly revenue was up 16.3% compared to the same quarter last year. Tecnoglass updated its FY 2025 guidance to EPS.

Tecnoglass Price Performance

Shares of NASDAQ:TGLS traded down $3.95 during trading on Thursday, reaching $79.12. The stock had a trading volume of 786,349 shares, compared to its average volume of 357,922. The company has a debt-to-equity ratio of 0.20, a quick ratio of 1.63 and a current ratio of 2.21. The business has a fifty day moving average price of $77.82 and a 200-day moving average price of $75.59. The stock has a market cap of $3.72 billion, a PE ratio of 24.72 and a beta of 1.85. Tecnoglass has a 1-year low of $58.03 and a 1-year high of $90.34.

Tecnoglass Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, July 31st. Stockholders of record on Monday, June 30th were paid a $0.15 dividend. The ex-dividend date of this dividend was Monday, June 30th. This represents a $0.60 dividend on an annualized basis and a dividend yield of 0.8%. Tecnoglass's payout ratio is currently 15.42%.

Hedge Funds Weigh In On Tecnoglass

A number of institutional investors and hedge funds have recently added to or reduced their stakes in TGLS. Jane Street Group LLC boosted its stake in Tecnoglass by 2,640.4% during the second quarter. Jane Street Group LLC now owns 326,113 shares of the company's stock worth $25,228,000 after buying an additional 314,213 shares during the last quarter. Qube Research & Technologies Ltd boosted its stake in Tecnoglass by 735.4% during the second quarter. Qube Research & Technologies Ltd now owns 118,038 shares of the company's stock worth $9,131,000 after buying an additional 103,909 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its stake in Tecnoglass by 35.6% during the second quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 88,397 shares of the company's stock worth $6,838,000 after buying an additional 23,185 shares during the last quarter. Invesco Ltd. boosted its stake in Tecnoglass by 18.1% during the second quarter. Invesco Ltd. now owns 138,163 shares of the company's stock worth $10,688,000 after buying an additional 21,220 shares during the last quarter. Finally, NewEdge Advisors LLC acquired a new position in Tecnoglass during the second quarter worth $503,000. Institutional investors and hedge funds own 37.35% of the company's stock.

Analyst Upgrades and Downgrades

Separately, B. Riley started coverage on Tecnoglass in a research note on Friday, May 16th. They issued a "buy" rating and a $100.00 price target on the stock. Three analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $89.00.

Read Our Latest Stock Report on TGLS

About Tecnoglass

(

Get Free Report)

Tecnoglass Inc manufactures, supplies, and installs architectural glass, windows, and associated aluminum and vinyl products for commercial and residential construction markets in Colombia, the United States, Panama, and internationally. The company provides low emissivity, laminated/thermo-laminated, thermo-acoustic, tempered, silk-screened, curved, and digital print glass products.

Read More

Before you consider Tecnoglass, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tecnoglass wasn't on the list.

While Tecnoglass currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.