TEGNA (NYSE:TGNA - Get Free Report) was downgraded by Wells Fargo & Company from a "strong-buy" rating to a "hold" rating in a report released on Thursday,Zacks.com reports.

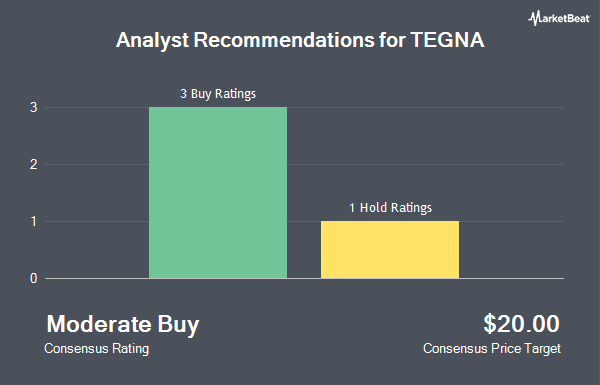

Several other equities analysts have also issued reports on TGNA. Weiss Ratings reaffirmed a "buy (b-)" rating on shares of TEGNA in a research note on Wednesday, October 8th. Guggenheim reaffirmed a "neutral" rating and set a $19.00 price target on shares of TEGNA in a research note on Friday, August 22nd. Finally, Zacks Research lowered TEGNA from a "hold" rating to a "strong sell" rating in a research note on Friday, October 10th. Two research analysts have rated the stock with a Buy rating, three have issued a Hold rating and one has assigned a Sell rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average target price of $19.75.

View Our Latest Report on TEGNA

TEGNA Trading Up 0.3%

Shares of TGNA opened at $19.98 on Thursday. The stock has a fifty day moving average price of $20.64 and a two-hundred day moving average price of $18.11. The company has a debt-to-equity ratio of 0.82, a quick ratio of 1.47 and a current ratio of 1.47. TEGNA has a 52-week low of $14.87 and a 52-week high of $21.35. The company has a market cap of $3.22 billion, a price-to-earnings ratio of 7.19 and a beta of 0.25.

TEGNA (NYSE:TGNA - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The company reported $0.44 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.38 by $0.06. The firm had revenue of $675.05 million during the quarter, compared to the consensus estimate of $673.92 million. TEGNA had a return on equity of 16.20% and a net margin of 14.99%.The business's revenue for the quarter was down 5.0% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.50 EPS. TEGNA has set its Q3 2025 guidance at EPS. Analysts predict that TEGNA will post 3.02 EPS for the current fiscal year.

Institutional Investors Weigh In On TEGNA

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Public Sector Pension Investment Board increased its holdings in TEGNA by 48.7% in the first quarter. Public Sector Pension Investment Board now owns 596,868 shares of the company's stock valued at $10,875,000 after purchasing an additional 195,396 shares during the last quarter. Principal Financial Group Inc. increased its holdings in TEGNA by 2.5% in the first quarter. Principal Financial Group Inc. now owns 934,711 shares of the company's stock valued at $17,030,000 after purchasing an additional 23,094 shares during the last quarter. Jupiter Asset Management Ltd. bought a new stake in TEGNA in the first quarter valued at about $5,371,000. Deutsche Bank AG increased its holdings in TEGNA by 383.6% in the first quarter. Deutsche Bank AG now owns 756,941 shares of the company's stock valued at $13,791,000 after purchasing an additional 600,407 shares during the last quarter. Finally, Allspring Global Investments Holdings LLC increased its holdings in shares of TEGNA by 53.9% in the first quarter. Allspring Global Investments Holdings LLC now owns 18,376 shares of the company's stock worth $341,000 after acquiring an additional 6,433 shares in the last quarter. Institutional investors own 92.19% of the company's stock.

About TEGNA

(

Get Free Report)

TEGNA Inc, a media company, provides broadcast advertising and marketing products and services for businesses. The company operates 47 television stations in 39 markets of the United States that produce local programming, such as news, sports, and entertainment. It offers local and national non-political advertising; political advertising; production of programming from third parties; production of advertising materials; and digital marketing services, as well as advertising services on the stations' Websites, tablets, and mobile products.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TEGNA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TEGNA wasn't on the list.

While TEGNA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.