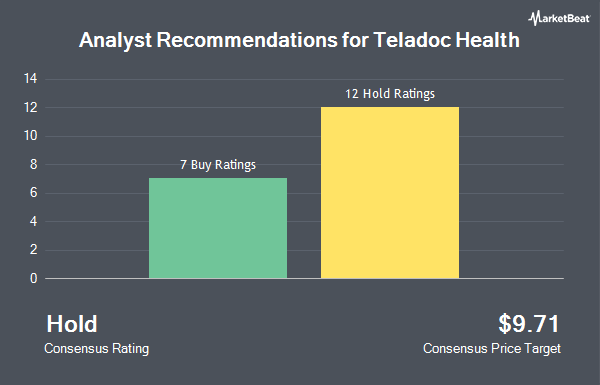

Shares of Teladoc Health, Inc. (NYSE:TDOC - Get Free Report) have been given an average rating of "Hold" by the nineteen ratings firms that are currently covering the firm, Marketbeat reports. Twelve research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. The average twelve-month target price among brokers that have issued ratings on the stock in the last year is $9.60.

Several analysts have weighed in on TDOC shares. Stifel Nicolaus lowered their price target on Teladoc Health from $9.00 to $8.00 and set a "hold" rating on the stock in a report on Thursday, May 1st. Evercore ISI lowered their price target on Teladoc Health from $8.00 to $7.00 and set an "in-line" rating on the stock in a report on Thursday, May 1st. Truist Financial lowered their price target on Teladoc Health from $10.00 to $9.00 and set a "hold" rating on the stock in a report on Tuesday, May 27th. Needham & Company LLC reaffirmed a "hold" rating on shares of Teladoc Health in a report on Thursday, May 1st. Finally, Jefferies Financial Group lowered their price target on Teladoc Health from $10.00 to $8.00 and set a "hold" rating on the stock in a report on Monday, April 21st.

Read Our Latest Analysis on TDOC

Teladoc Health Price Performance

TDOC traded up $0.38 during trading on Thursday, reaching $8.43. 18,170,643 shares of the company were exchanged, compared to its average volume of 6,340,035. The company's 50-day moving average is $7.19 and its two-hundred day moving average is $8.74. The company has a market cap of $1.48 billion, a price-to-earnings ratio of -1.42 and a beta of 1.78. The company has a quick ratio of 1.64, a current ratio of 1.68 and a debt-to-equity ratio of 0.70. Teladoc Health has a 12-month low of $6.35 and a 12-month high of $15.21.

Insider Buying and Selling

In other Teladoc Health news, insider Fernando M. Rodrigues sold 4,174 shares of the business's stock in a transaction dated Tuesday, June 3rd. The stock was sold at an average price of $6.91, for a total transaction of $28,842.34. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider Carlos Nueno sold 3,958 shares of the business's stock in a transaction dated Monday, June 2nd. The shares were sold at an average price of $6.86, for a total value of $27,151.88. Following the sale, the insider now directly owns 17,645 shares of the company's stock, valued at $121,044.70. This represents a 18.32% decrease in their position. The disclosure for this sale can be found here. Insiders sold 18,656 shares of company stock valued at $128,189 over the last 90 days. Company insiders own 0.58% of the company's stock.

Hedge Funds Weigh In On Teladoc Health

A number of hedge funds have recently made changes to their positions in TDOC. Rhumbline Advisers boosted its stake in shares of Teladoc Health by 1.8% in the fourth quarter. Rhumbline Advisers now owns 281,420 shares of the health services provider's stock worth $2,558,000 after acquiring an additional 5,018 shares during the period. Ieq Capital LLC bought a new position in shares of Teladoc Health in the fourth quarter worth about $111,000. Handelsbanken Fonder AB boosted its stake in shares of Teladoc Health by 27.1% in the fourth quarter. Handelsbanken Fonder AB now owns 36,600 shares of the health services provider's stock worth $333,000 after acquiring an additional 7,800 shares during the period. Impact Investors Inc bought a new position in shares of Teladoc Health in the fourth quarter worth about $168,000. Finally, Whipplewood Advisors LLC bought a new position in shares of Teladoc Health in the fourth quarter worth about $29,000. Institutional investors own 76.82% of the company's stock.

Teladoc Health Company Profile

(

Get Free ReportTeladoc Health, Inc provides virtual healthcare services worldwide. The company operates through Teladoc Health Integrated Care and BetterHelp segments. The Integrated Care segment offers virtual medical services, including general medical, expert medical, specialty medical, chronic condition management, and mental health, as well as enabling technologies and enterprise telehealth solutions for hospitals and health systems.

Featured Articles

Before you consider Teladoc Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teladoc Health wasn't on the list.

While Teladoc Health currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.