Warby Parker (NYSE:WRBY - Get Free Report)'s stock had its "outperform" rating reaffirmed by equities researchers at Telsey Advisory Group in a note issued to investors on Thursday,Benzinga reports. They presently have a $28.00 price objective on the stock. Telsey Advisory Group's target price points to a potential upside of 19.28% from the company's current price.

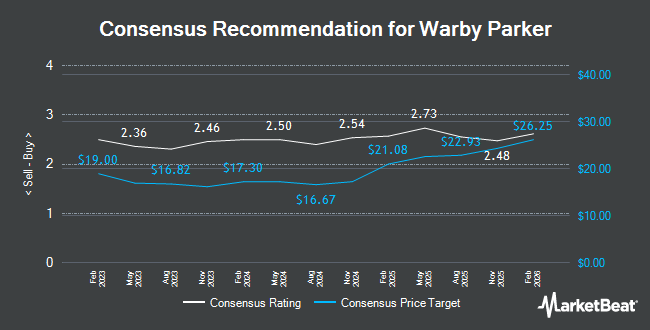

Several other equities research analysts also recently issued reports on WRBY. Roth Capital set a $24.00 price target on shares of Warby Parker and gave the stock a "neutral" rating in a research note on Tuesday. UBS Group reduced their target price on shares of Warby Parker from $23.00 to $20.00 and set a "neutral" rating for the company in a research note on Tuesday, May 13th. Robert W. Baird set a $30.00 target price on shares of Warby Parker and gave the stock an "outperform" rating in a report on Wednesday, July 30th. Stifel Nicolaus upped their price objective on shares of Warby Parker from $18.00 to $21.00 and gave the stock a "hold" rating in a report on Wednesday, May 21st. Finally, Loop Capital reiterated a "buy" rating on shares of Warby Parker in a research report on Wednesday, May 21st. Nine analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to data from MarketBeat.com, Warby Parker has an average rating of "Moderate Buy" and an average price target of $23.81.

View Our Latest Stock Report on WRBY

Warby Parker Price Performance

Warby Parker stock traded down $0.83 during mid-day trading on Thursday, reaching $23.48. The company had a trading volume of 5,058,634 shares, compared to its average volume of 2,255,414. Warby Parker has a 1 year low of $12.46 and a 1 year high of $29.73. The company has a market capitalization of $2.45 billion, a P/E ratio of -195.63 and a beta of 2.09. The stock's 50-day simple moving average is $22.54 and its 200-day simple moving average is $21.10.

Insiders Place Their Bets

In other news, Director Youngme E. Moon sold 33,073 shares of the company's stock in a transaction dated Thursday, May 22nd. The stock was sold at an average price of $19.90, for a total transaction of $658,152.70. Following the completion of the sale, the director owned 53,869 shares in the company, valued at approximately $1,071,993.10. This represents a 38.04% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CEO Neil Harris Blumenthal sold 49,600 shares of the stock in a transaction that occurred on Monday, July 21st. The stock was sold at an average price of $24.21, for a total value of $1,200,816.00. Following the completion of the transaction, the chief executive officer directly owned 28,347 shares of the company's stock, valued at approximately $686,280.87. The trade was a 63.63% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 83,073 shares of company stock worth $1,868,573 over the last ninety days. 18.24% of the stock is owned by insiders.

Institutional Trading of Warby Parker

Several hedge funds and other institutional investors have recently modified their holdings of WRBY. Universal Beteiligungs und Servicegesellschaft mbH bought a new stake in shares of Warby Parker in the first quarter valued at approximately $2,029,000. New York State Teachers Retirement System acquired a new stake in Warby Parker in the first quarter valued at $27,000. Jennison Associates LLC increased its holdings in Warby Parker by 23.7% in the first quarter. Jennison Associates LLC now owns 2,174,158 shares of the company's stock valued at $39,635,000 after purchasing an additional 416,797 shares during the period. Northern Trust Corp lifted its stake in shares of Warby Parker by 7.5% in the 4th quarter. Northern Trust Corp now owns 811,038 shares of the company's stock valued at $19,635,000 after purchasing an additional 56,674 shares during the period. Finally, SG Americas Securities LLC acquired a new stake in shares of Warby Parker in the 1st quarter valued at about $602,000. Institutional investors and hedge funds own 93.24% of the company's stock.

Warby Parker Company Profile

(

Get Free Report)

Warby Parker Inc provides eyewear products in the United States and Canada. The company offers eyeglasses, sunglasses, light-responsive lenses, blue-light-filtering lenses, non-prescription lenses, and contact lenses. It also provides accessories, such as cases, lenses kit with anti-fog spray, pouches, and anti-fog lens spray through its retail stores, website, and mobile apps.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Warby Parker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warby Parker wasn't on the list.

While Warby Parker currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.