Telus Digital (NYSE:TIXT - Get Free Report)'s stock had its "sell (d)" rating reissued by research analysts at Weiss Ratings in a report issued on Friday,Weiss Ratings reports.

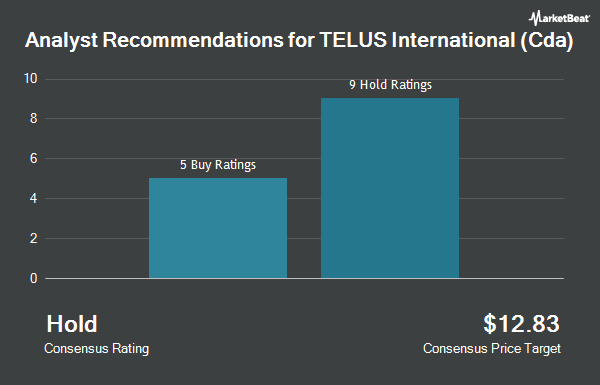

Other equities research analysts have also issued research reports about the company. Stifel Canada lowered Telus Digital from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, September 2nd. National Bank Financial lowered Telus Digital from an "outperform" rating to a "sector perform" rating and set a $4.00 price target for the company. in a research note on Monday, July 21st. Morgan Stanley cut their price target on Telus Digital from $3.49 to $3.40 and set an "equal weight" rating for the company in a research note on Monday, August 4th. Scotiabank raised their price objective on Telus Digital from $3.40 to $4.50 and gave the company a "sector perform" rating in a research report on Thursday, September 4th. Finally, Stifel Nicolaus cut Telus Digital from a "buy" rating to a "hold" rating and lifted their target price for the stock from $4.00 to $4.50 in a report on Wednesday, September 3rd. Eight research analysts have rated the stock with a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Reduce" and a consensus price target of $3.93.

Check Out Our Latest Stock Report on Telus Digital

Telus Digital Trading Up 0.3%

Shares of TIXT stock opened at $4.36 on Friday. Telus Digital has a 52-week low of $2.13 and a 52-week high of $4.60. The company has a debt-to-equity ratio of 0.85, a quick ratio of 0.84 and a current ratio of 0.84. The firm has a market capitalization of $1.21 billion, a PE ratio of -3.13 and a beta of 0.94. The stock has a fifty day simple moving average of $4.34 and a two-hundred day simple moving average of $3.60.

Telus Digital (NYSE:TIXT - Get Free Report) last issued its quarterly earnings results on Friday, August 1st. The company reported $0.06 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.05 by $0.01. Telus Digital had a positive return on equity of 1.99% and a negative net margin of 14.09%.The business had revenue of $711.33 million during the quarter, compared to analyst estimates of $660.87 million. Telus Digital has set its FY 2025 guidance at 0.320-0.320 EPS. On average, analysts predict that Telus Digital will post 0.32 EPS for the current fiscal year.

Hedge Funds Weigh In On Telus Digital

Several institutional investors have recently added to or reduced their stakes in TIXT. Gabelli Funds LLC purchased a new position in Telus Digital in the second quarter worth about $36,000. Dynamic Technology Lab Private Ltd purchased a new position in Telus Digital in the first quarter worth about $58,000. Avior Wealth Management LLC purchased a new position in Telus Digital in the second quarter worth about $85,000. PDT Partners LLC grew its position in Telus Digital by 79.9% in the first quarter. PDT Partners LLC now owns 28,058 shares of the company's stock worth $75,000 after acquiring an additional 12,458 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank grew its position in Telus Digital by 87.4% in the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 38,086 shares of the company's stock worth $102,000 after acquiring an additional 17,764 shares in the last quarter. Hedge funds and other institutional investors own 59.55% of the company's stock.

Telus Digital Company Profile

(

Get Free Report)

TELUS Digital Inc design, builds, and delivers digital solutions for customer experience (CX) in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally. The company provides digital experience solutions, such as AI and bots, omnichannel CX, enterprise mobility solutions, cloud contact center, big data analytics, platform transformation, and UX/UI design; and customer experience solutions, including work anywhere/work from home, contact center outsourcing, technical support, sales growth and customer retention, healthcare/patient experience, and debt collection.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Telus Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Telus Digital wasn't on the list.

While Telus Digital currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.