Wall Street Zen upgraded shares of Teradata (NYSE:TDC - Free Report) from a hold rating to a buy rating in a research note published on Saturday morning.

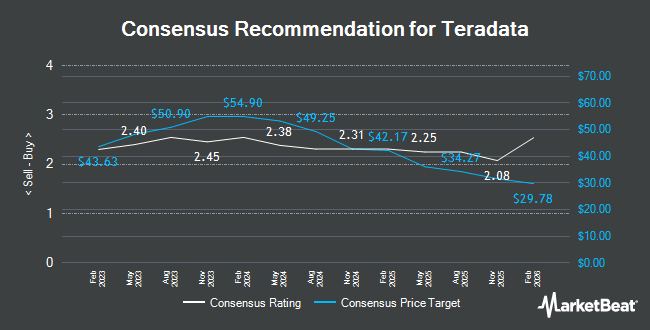

TDC has been the subject of several other reports. UBS Group decreased their target price on Teradata from $24.00 to $23.00 and set a "neutral" rating for the company in a research report on Wednesday, August 6th. Zacks Research lowered Teradata from a "hold" rating to a "strong sell" rating in a report on Monday, September 8th. Three investment analysts have rated the stock with a Buy rating, five have issued a Hold rating and two have assigned a Sell rating to the stock. According to MarketBeat, Teradata presently has a consensus rating of "Hold" and a consensus price target of $26.86.

Read Our Latest Stock Analysis on Teradata

Teradata Stock Up 1.8%

NYSE:TDC traded up $0.40 during trading hours on Friday, hitting $22.21. 1,115,806 shares of the company traded hands, compared to its average volume of 833,499. The company has a quick ratio of 0.84, a current ratio of 0.84 and a debt-to-equity ratio of 2.78. The firm's 50-day simple moving average is $21.22 and its 200-day simple moving average is $21.79. Teradata has a one year low of $18.43 and a one year high of $33.69. The company has a market cap of $2.10 billion, a PE ratio of 19.65, a PEG ratio of 5.53 and a beta of 0.78.

Teradata (NYSE:TDC - Get Free Report) last issued its quarterly earnings data on Tuesday, August 5th. The technology company reported $0.47 earnings per share for the quarter, beating the consensus estimate of $0.41 by $0.06. Teradata had a return on equity of 96.29% and a net margin of 6.57%.The business had revenue of $408.00 million for the quarter, compared to analysts' expectations of $399.73 million. During the same period last year, the business earned $0.64 EPS. The business's revenue was down 6.4% on a year-over-year basis. Teradata has set its Q3 2025 guidance at 0.510-0.55 EPS. FY 2025 guidance at 2.170-2.25 EPS. Equities analysts predict that Teradata will post 1.31 earnings per share for the current year.

Hedge Funds Weigh In On Teradata

Large investors have recently bought and sold shares of the stock. Laurel Wealth Advisors LLC increased its stake in Teradata by 2,132.0% in the 2nd quarter. Laurel Wealth Advisors LLC now owns 1,116 shares of the technology company's stock worth $25,000 after purchasing an additional 1,066 shares during the period. Tsfg LLC purchased a new position in Teradata in the 1st quarter worth approximately $26,000. IFP Advisors Inc increased its stake in Teradata by 405.4% in the 2nd quarter. IFP Advisors Inc now owns 1,223 shares of the technology company's stock worth $27,000 after purchasing an additional 981 shares during the period. Steward Partners Investment Advisory LLC increased its stake in Teradata by 64.1% in the 2nd quarter. Steward Partners Investment Advisory LLC now owns 1,364 shares of the technology company's stock worth $30,000 after purchasing an additional 533 shares during the period. Finally, First Command Advisory Services Inc. purchased a new position in Teradata in the 2nd quarter worth approximately $42,000. 90.31% of the stock is owned by hedge funds and other institutional investors.

About Teradata

(

Get Free Report)

Teradata Corporation, together with its subsidiaries, provides a connected multi-cloud data platform for enterprise analytics. The company offers Teradata Vantage, an open and connected platform designed to leverage data across an enterprise. Its business consulting services include support services for organizations to establish a data and analytic vision, enable a multi-cloud ecosystem architecture, and identify and operationalize analytical opportunities, as well as to ensure the analytical infrastructure delivers value.

Read More

Before you consider Teradata, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradata wasn't on the list.

While Teradata currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.