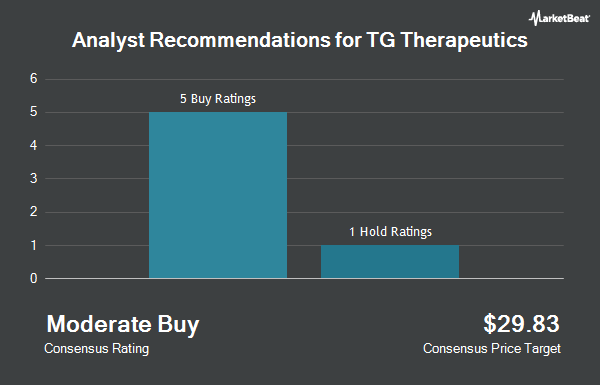

Shares of TG Therapeutics, Inc. (NASDAQ:TGTX - Get Free Report) have been assigned an average rating of "Moderate Buy" from the five research firms that are covering the firm, MarketBeat.com reports. One investment analyst has rated the stock with a hold rating and four have assigned a buy rating to the company. The average 1-year target price among brokers that have issued ratings on the stock in the last year is $43.80.

Separately, The Goldman Sachs Group raised shares of TG Therapeutics to a "hold" rating and set a $37.00 price target on the stock in a report on Thursday.

View Our Latest Report on TGTX

TG Therapeutics Stock Down 1.6%

NASDAQ TGTX traded down $0.59 on Thursday, hitting $37.08. The stock had a trading volume of 957,478 shares, compared to its average volume of 2,876,739. The business's fifty day moving average price is $36.05 and its 200 day moving average price is $35.32. The company has a debt-to-equity ratio of 1.03, a current ratio of 4.02 and a quick ratio of 3.04. TG Therapeutics has a 52-week low of $16.65 and a 52-week high of $46.48. The stock has a market cap of $5.89 billion, a price-to-earnings ratio of 154.50 and a beta of 1.91.

TG Therapeutics (NASDAQ:TGTX - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The biopharmaceutical company reported $0.03 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.19 by ($0.16). TG Therapeutics had a return on equity of 18.88% and a net margin of 10.13%. The firm had revenue of $120.86 million during the quarter, compared to analysts' expectations of $117.07 million. During the same period in the prior year, the firm posted ($0.07) earnings per share. TG Therapeutics's revenue for the quarter was up 90.4% compared to the same quarter last year. Equities research analysts anticipate that TG Therapeutics will post 0.08 earnings per share for the current year.

Insider Activity at TG Therapeutics

In other news, Director Yann Echelard sold 10,000 shares of TG Therapeutics stock in a transaction on Friday, June 13th. The shares were sold at an average price of $36.94, for a total transaction of $369,400.00. Following the completion of the sale, the director directly owned 228,816 shares in the company, valued at approximately $8,452,463.04. The trade was a 4.19% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Insiders own 10.64% of the company's stock.

Institutional Investors Weigh In On TG Therapeutics

Institutional investors and hedge funds have recently made changes to their positions in the stock. Raymond James Financial Inc. acquired a new stake in shares of TG Therapeutics during the fourth quarter worth $14,508,000. Charles Schwab Investment Management Inc. lifted its stake in shares of TG Therapeutics by 7.2% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,269,513 shares of the biopharmaceutical company's stock worth $38,212,000 after buying an additional 84,904 shares during the period. Norges Bank acquired a new stake in shares of TG Therapeutics during the fourth quarter worth $12,085,000. Allspring Global Investments Holdings LLC lifted its position in TG Therapeutics by 54.0% during the first quarter. Allspring Global Investments Holdings LLC now owns 23,775 shares of the biopharmaceutical company's stock valued at $898,000 after purchasing an additional 8,338 shares during the period. Finally, New York State Teachers Retirement System lifted its position in TG Therapeutics by 175.0% during the first quarter. New York State Teachers Retirement System now owns 120,364 shares of the biopharmaceutical company's stock valued at $4,746,000 after purchasing an additional 76,600 shares during the period. 58.58% of the stock is currently owned by institutional investors and hedge funds.

TG Therapeutics Company Profile

(

Get Free ReportTG Therapeutics, Inc, a commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally. It provides BRIUMVI, an anti-CD20 monoclonal antibody for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease in adults.

Read More

Before you consider TG Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TG Therapeutics wasn't on the list.

While TG Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.