The Manufacturers Life Insurance Company cut its holdings in Tower Semiconductor Ltd. (NASDAQ:TSEM - Free Report) by 19.8% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 869,484 shares of the semiconductor company's stock after selling 214,248 shares during the period. The Manufacturers Life Insurance Company owned 0.78% of Tower Semiconductor worth $44,787,000 as of its most recent filing with the SEC.

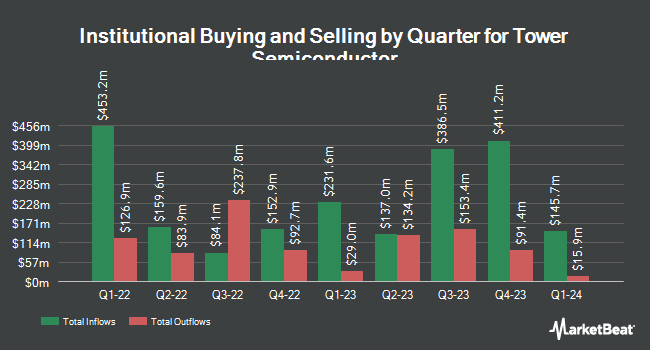

Several other large investors have also made changes to their positions in TSEM. R Squared Ltd bought a new position in Tower Semiconductor in the 4th quarter worth approximately $61,000. Blue Trust Inc. increased its position in Tower Semiconductor by 12.7% during the fourth quarter. Blue Trust Inc. now owns 2,037 shares of the semiconductor company's stock worth $105,000 after acquiring an additional 230 shares during the period. Crews Bank & Trust acquired a new position in Tower Semiconductor during the 4th quarter valued at $134,000. Cornerstone Investment Partners LLC bought a new stake in Tower Semiconductor in the 4th quarter valued at $203,000. Finally, Callan Family Office LLC acquired a new stake in Tower Semiconductor in the 4th quarter worth $323,000. Institutional investors and hedge funds own 70.51% of the company's stock.

Tower Semiconductor Price Performance

Shares of TSEM stock traded down $0.58 during trading hours on Tuesday, hitting $35.95. The company had a trading volume of 211,599 shares, compared to its average volume of 562,169. Tower Semiconductor Ltd. has a 12 month low of $28.64 and a 12 month high of $55.31. The company has a debt-to-equity ratio of 0.05, a quick ratio of 5.23 and a current ratio of 6.18. The firm's fifty day moving average is $36.65 and its 200 day moving average is $44.25. The firm has a market capitalization of $3.98 billion, a price-to-earnings ratio of 19.33 and a beta of 0.75.

Wall Street Analyst Weigh In

A number of research firms recently weighed in on TSEM. Benchmark reissued a "buy" rating and set a $60.00 target price on shares of Tower Semiconductor in a research report on Thursday, May 1st. Wedbush reissued an "outperform" rating and set a $60.00 price objective on shares of Tower Semiconductor in a report on Tuesday, February 11th. One analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, Tower Semiconductor presently has an average rating of "Moderate Buy" and a consensus target price of $60.00.

View Our Latest Analysis on TSEM

Tower Semiconductor Profile

(

Free Report)

Tower Semiconductor Ltd., an independent semiconductor foundry, focus on specialty process technologies to manufacture analog intensive mixed-signal semiconductor devices in Israel, the United States, Japan, Europe, and internationally. It provides various customizable process technologies, including SiGe, BiCMOS, mixed signal/CMOS, RF CMOS, CMOS image sensor, integrated power management, and MEMS.

Recommended Stories

Before you consider Tower Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tower Semiconductor wasn't on the list.

While Tower Semiconductor currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.