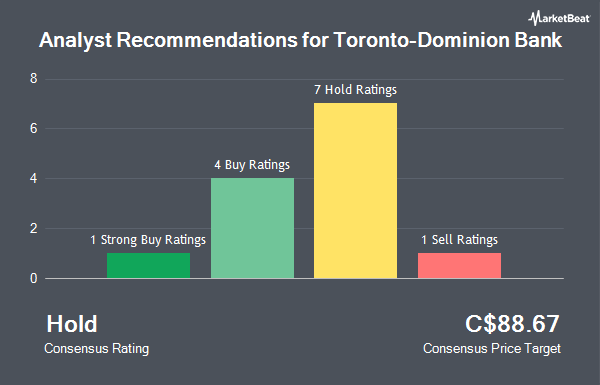

Shares of The Toronto-Dominion Bank (TSE:TD - Get Free Report) NYSE: TD have been given an average recommendation of "Hold" by the thirteen ratings firms that are covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell recommendation, seven have assigned a hold recommendation, four have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 12-month target price among brokerages that have updated their coverage on the stock in the last year is C$88.75.

Several analysts recently weighed in on TD shares. National Bankshares decreased their price objective on Toronto-Dominion Bank from C$84.00 to C$80.00 and set a "sector perform" rating for the company in a report on Monday, April 7th. Royal Bank of Canada increased their price objective on shares of Toronto-Dominion Bank from C$77.00 to C$86.00 and gave the company a "sector perform" rating in a research note on Wednesday, January 8th. Jefferies Financial Group lowered Toronto-Dominion Bank from a "buy" rating to a "hold" rating and upped their target price for the stock from C$90.00 to C$99.00 in a report on Tuesday, February 18th. UBS Group lifted their price target on Toronto-Dominion Bank from C$83.00 to C$90.00 in a report on Friday, February 14th. Finally, CIBC reduced their price target on Toronto-Dominion Bank from C$96.00 to C$95.00 in a research report on Thursday, March 6th.

View Our Latest Research Report on TD

Toronto-Dominion Bank Trading Down 0.2 %

Shares of TD stock traded down C$0.16 during trading hours on Wednesday, reaching C$88.18. 6,379,405 shares of the stock were exchanged, compared to its average volume of 8,757,738. The firm has a market capitalization of C$154.70 billion, a price-to-earnings ratio of 17.47, a price-to-earnings-growth ratio of 1.22 and a beta of 0.82. Toronto-Dominion Bank has a 12-month low of C$73.22 and a 12-month high of C$88.55. The company's 50-day moving average price is C$84.73 and its 200-day moving average price is C$81.33.

Toronto-Dominion Bank Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, April 30th. Stockholders of record on Wednesday, April 30th were given a $1.05 dividend. This represents a $4.20 dividend on an annualized basis and a dividend yield of 4.76%. The ex-dividend date of this dividend was Thursday, April 10th. Toronto-Dominion Bank's dividend payout ratio is currently 80.84%.

Insider Buying and Selling at Toronto-Dominion Bank

In related news, Director Ajay Kumar Virmani acquired 24,636 shares of the business's stock in a transaction on Wednesday, April 9th. The shares were bought at an average cost of C$81.22 per share, with a total value of C$2,000,935.92. Also, Director Theresa Lynn Currie sold 45,172 shares of the business's stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of C$86.50, for a total value of C$3,907,378.00. Following the transaction, the director now directly owns 163 shares in the company, valued at C$14,099.50. This trade represents a 99.64 % decrease in their ownership of the stock. 0.08% of the stock is currently owned by insiders.

Toronto-Dominion Bank Company Profile

(

Get Free ReportThe Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

Read More

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.