Toronto-Dominion Bank (TSE:TD - Free Report) NYSE: TD had its price objective boosted by National Bankshares from C$98.00 to C$99.00 in a research note issued to investors on Friday,BayStreet.CA reports. National Bankshares currently has a sector perform rating on the stock.

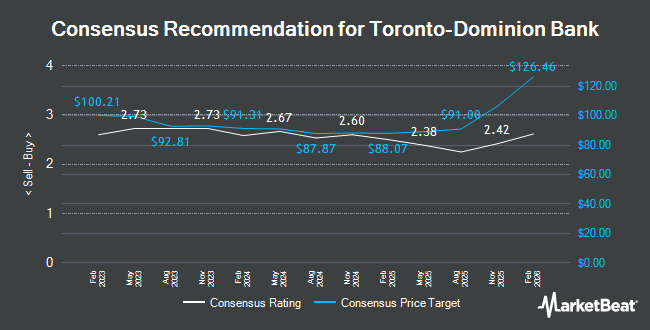

Other equities analysts also recently issued reports about the stock. Barclays lifted their price target on shares of Toronto-Dominion Bank from C$91.00 to C$95.00 and gave the company an "underweight" rating in a report on Thursday, August 14th. Scotiabank raised shares of Toronto-Dominion Bank to a "hold" rating in a report on Wednesday, May 14th. CIBC lifted their target price on shares of Toronto-Dominion Bank from C$96.00 to C$99.00 and gave the company an "outperform" rating in a research note on Thursday, June 5th. Jefferies Financial Group boosted their target price on Toronto-Dominion Bank from C$103.00 to C$117.00 in a report on Wednesday, August 13th. Finally, Desjardins upgraded Toronto-Dominion Bank from a "hold" rating to a "buy" rating and increased their price target for the stock from C$97.00 to C$107.00 in a research report on Wednesday, August 13th. Four analysts have rated the stock with a Buy rating, five have assigned a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat, Toronto-Dominion Bank presently has an average rating of "Hold" and a consensus price target of C$96.08.

View Our Latest Research Report on Toronto-Dominion Bank

Toronto-Dominion Bank Stock Up 0.5%

Toronto-Dominion Bank stock traded up C$0.55 during mid-day trading on Friday, hitting C$102.24. 2,991,087 shares of the company were exchanged, compared to its average volume of 7,593,967. The company has a market capitalization of C$179.37 billion, a PE ratio of 20.26, a price-to-earnings-growth ratio of 1.22 and a beta of 0.82. The business has a fifty day moving average of C$100.49 and a 200 day moving average of C$91.56. Toronto-Dominion Bank has a 1-year low of C$73.22 and a 1-year high of C$103.11.

Toronto-Dominion Bank Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, July 31st. Stockholders of record on Thursday, July 31st were paid a dividend of $1.05 per share. This represents a $4.20 dividend on an annualized basis and a dividend yield of 4.1%. The ex-dividend date was Thursday, July 10th. Toronto-Dominion Bank's dividend payout ratio is currently 80.84%.

Insider Buying and Selling

In related news, Senior Officer Paul Martyn Clark sold 16,936 shares of the stock in a transaction that occurred on Monday, June 2nd. The stock was sold at an average price of C$94.87, for a total transaction of C$1,606,718.32. Following the completion of the transaction, the insider directly owned 260 shares of the company's stock, valued at approximately C$24,666.20. This represents a 98.49% decrease in their ownership of the stock. Also, Senior Officer Kelvin Vi Luan Tran sold 9,612 shares of the firm's stock in a transaction that occurred on Monday, June 2nd. The shares were sold at an average price of C$94.98, for a total value of C$912,947.76. Insiders have sold 81,612 shares of company stock worth $7,748,610 over the last three months. Company insiders own 0.08% of the company's stock.

About Toronto-Dominion Bank

(

Get Free Report)

Toronto-Dominion is one of Canada's two largest banks and operates three business segments: Canadian retail banking, U.S. retail banking, and wholesale banking. The bank's U.S. operations span from Maine to Florida, with a strong presence in the Northeast. It also has a 13% ownership stake in Charles Schwab.

Featured Articles

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.