Trade Desk (NASDAQ:TTD - Get Free Report) was downgraded by Wall Street Zen from a "hold" rating to a "sell" rating in a report released on Saturday.

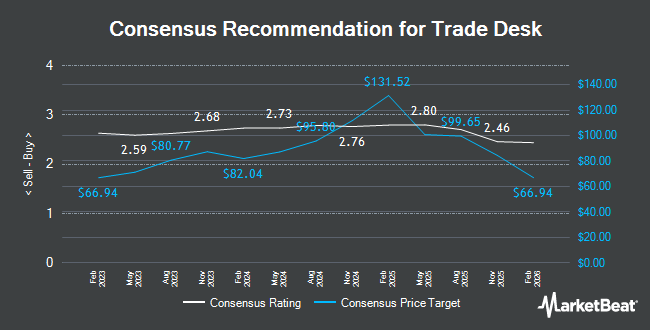

A number of other brokerages also recently weighed in on TTD. KeyCorp boosted their target price on shares of Trade Desk from $80.00 to $95.00 and gave the stock an "overweight" rating in a report on Thursday, July 17th. BMO Capital Markets set a $98.00 target price on shares of Trade Desk and gave the stock an "outperform" rating in a report on Friday, August 8th. Needham & Company LLC restated a "buy" rating and set a $84.00 target price on shares of Trade Desk in a report on Monday, August 11th. Wedbush restated an "outperform" rating and set a $86.00 target price on shares of Trade Desk in a report on Tuesday, July 15th. Finally, Guggenheim reduced their price objective on shares of Trade Desk from $110.00 to $90.00 and set a "buy" rating for the company in a research report on Friday, May 9th. Four analysts have rated the stock with a sell rating, eleven have issued a hold rating and twenty-one have given a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus price target of $88.58.

Get Our Latest Research Report on Trade Desk

Trade Desk Stock Up 2.7%

NASDAQ TTD opened at $52.12 on Friday. Trade Desk has a 12-month low of $42.96 and a 12-month high of $141.53. The company has a market capitalization of $25.61 billion, a PE ratio of 62.80, a price-to-earnings-growth ratio of 2.60 and a beta of 1.37. The firm's 50 day moving average is $74.22 and its 200-day moving average is $71.04.

Trade Desk (NASDAQ:TTD - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The technology company reported $0.18 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.42 by ($0.24). The business had revenue of $694.04 million during the quarter, compared to analyst estimates of $686.00 million. Trade Desk had a net margin of 15.57% and a return on equity of 15.19%. Trade Desk's revenue for the quarter was up 18.7% on a year-over-year basis. During the same quarter last year, the business earned $0.39 earnings per share. As a group, sell-side analysts expect that Trade Desk will post 1.06 EPS for the current year.

Insider Buying and Selling

In other news, insider Jay R. Grant sold 51,290 shares of the stock in a transaction dated Thursday, August 7th. The shares were sold at an average price of $91.18, for a total value of $4,676,622.20. Following the completion of the transaction, the insider owned 218,246 shares of the company's stock, valued at approximately $19,899,670.28. This represents a 19.03% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 10.00% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently made changes to their positions in the stock. GAMMA Investing LLC increased its stake in shares of Trade Desk by 3,876.8% in the first quarter. GAMMA Investing LLC now owns 91,984 shares of the technology company's stock valued at $5,033,000 after buying an additional 89,671 shares during the period. Dynamic Advisor Solutions LLC acquired a new position in shares of Trade Desk in the first quarter valued at approximately $995,000. LBP AM SA increased its stake in shares of Trade Desk by 116.1% in the first quarter. LBP AM SA now owns 64,154 shares of the technology company's stock valued at $3,511,000 after buying an additional 34,465 shares during the period. Bryce Point Capital LLC increased its stake in shares of Trade Desk by 302.9% in the first quarter. Bryce Point Capital LLC now owns 16,727 shares of the technology company's stock valued at $915,000 after buying an additional 12,575 shares during the period. Finally, Peregrine Capital Management LLC increased its stake in shares of Trade Desk by 40.2% in the first quarter. Peregrine Capital Management LLC now owns 579,877 shares of the technology company's stock valued at $31,731,000 after buying an additional 166,332 shares during the period. Institutional investors own 67.77% of the company's stock.

About Trade Desk

(

Get Free Report)

The Trade Desk, Inc operates as a technology company in the United States and internationally. The company offers a self-service cloud-based platform that allows buyers to plan, manage, optimize, and measure data-driven digital advertising campaigns across various ad formats and channels, including video, display, audio, digital-out-of-home, native, and social on various devices, such as computers, mobile devices, televisions, and streaming devices.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Trade Desk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trade Desk wasn't on the list.

While Trade Desk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.