Trade Desk (NASDAQ:TTD - Get Free Report) is projected to announce its Q2 2025 earnings results after the market closes on Thursday, August 7th. Analysts expect Trade Desk to post earnings of $0.42 per share and revenue of $686.00 million for the quarter. Trade Desk has set its Q2 2025 guidance at EPS.

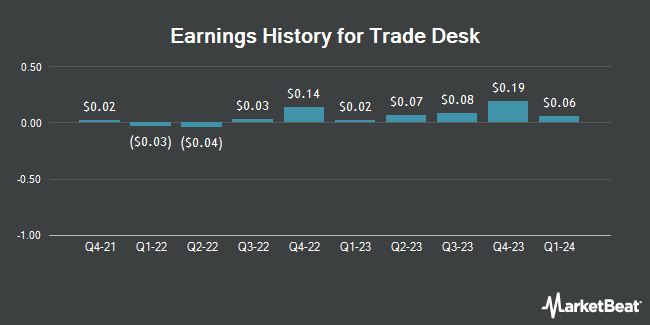

Trade Desk (NASDAQ:TTD - Get Free Report) last posted its earnings results on Thursday, May 8th. The technology company reported $0.33 earnings per share for the quarter, beating the consensus estimate of $0.26 by $0.07. Trade Desk had a return on equity of 15.41% and a net margin of 16.04%. The company had revenue of $616.02 million for the quarter, compared to analyst estimates of $575.62 million. During the same period last year, the company earned $0.26 earnings per share. The business's revenue was up 25.4% compared to the same quarter last year. On average, analysts expect Trade Desk to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Trade Desk Stock Up 3.3%

Shares of NASDAQ:TTD traded up $2.85 on Monday, reaching $88.93. The company had a trading volume of 4,537,270 shares, compared to its average volume of 10,079,852. The stock has a market capitalization of $43.70 billion, a P/E ratio of 108.51, a P/E/G ratio of 3.91 and a beta of 1.37. The stock has a 50-day moving average price of $75.63 and a 200 day moving average price of $74.12. Trade Desk has a twelve month low of $42.96 and a twelve month high of $141.53.

Insider Activity

In related news, CEO Jeffrey Terry Green sold 26,684 shares of the firm's stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $80.03, for a total transaction of $2,135,520.52. Following the transaction, the chief executive officer directly owned 17,018 shares of the company's stock, valued at approximately $1,361,950.54. This trade represents a 61.06% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director David B. Wells sold 28,638 shares of the business's stock in a transaction that occurred on Tuesday, May 13th. The shares were sold at an average price of $79.88, for a total value of $2,287,603.44. Following the completion of the sale, the director owned 66,985 shares of the company's stock, valued at approximately $5,350,761.80. This trade represents a 29.95% decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 10.00% of the company's stock.

Hedge Funds Weigh In On Trade Desk

Institutional investors have recently modified their holdings of the business. Woodline Partners LP grew its holdings in Trade Desk by 75.5% during the 1st quarter. Woodline Partners LP now owns 5,275 shares of the technology company's stock worth $289,000 after acquiring an additional 2,269 shares during the last quarter. Brighton Jones LLC raised its position in Trade Desk by 3.8% during the 4th quarter. Brighton Jones LLC now owns 4,586 shares of the technology company's stock worth $539,000 after purchasing an additional 169 shares during the last quarter. Finally, Bison Wealth LLC lifted its holdings in Trade Desk by 24.3% during the 4th quarter. Bison Wealth LLC now owns 2,480 shares of the technology company's stock worth $291,000 after buying an additional 485 shares during the period. Institutional investors and hedge funds own 67.77% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms recently issued reports on TTD. Needham & Company LLC reiterated a "buy" rating and issued a $84.00 target price on shares of Trade Desk in a research note on Friday, June 6th. KeyCorp boosted their price objective on Trade Desk from $80.00 to $95.00 and gave the stock an "overweight" rating in a research report on Thursday, July 17th. Jefferies Financial Group set a $125.00 target price on Trade Desk and gave the company a "buy" rating in a report on Tuesday, April 29th. Evercore ISI upgraded Trade Desk from an "in-line" rating to an "outperform" rating and set a $90.00 price target for the company in a report on Friday, June 27th. Finally, HSBC set a $75.00 price objective on shares of Trade Desk and gave the stock a "buy" rating in a research note on Wednesday, April 23rd. One equities research analyst has rated the stock with a sell rating, eight have issued a hold rating and twenty-six have assigned a buy rating to the company's stock. According to MarketBeat.com, Trade Desk has an average rating of "Moderate Buy" and an average target price of $98.73.

Check Out Our Latest Report on TTD

Trade Desk Company Profile

(

Get Free Report)

The Trade Desk, Inc operates as a technology company in the United States and internationally. The company offers a self-service cloud-based platform that allows buyers to plan, manage, optimize, and measure data-driven digital advertising campaigns across various ad formats and channels, including video, display, audio, digital-out-of-home, native, and social on various devices, such as computers, mobile devices, televisions, and streaming devices.

See Also

Before you consider Trade Desk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trade Desk wasn't on the list.

While Trade Desk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.