Trade Desk (NASDAQ:TTD - Get Free Report)'s stock had its "buy" rating restated by stock analysts at Needham & Company LLC in a research note issued on Monday,Benzinga reports. They currently have a $84.00 price target on the technology company's stock. Needham & Company LLC's price objective indicates a potential upside of 58.98% from the company's current price.

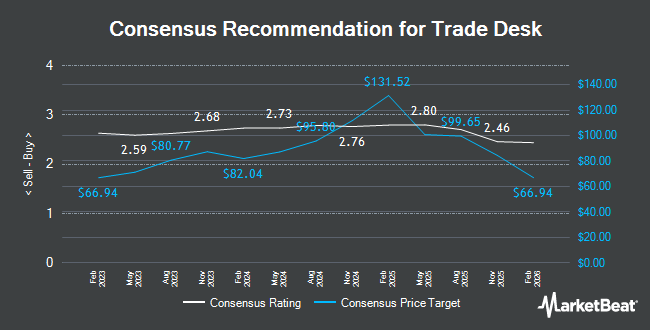

TTD has been the subject of several other reports. Wedbush reissued an "outperform" rating and issued a $86.00 price objective on shares of Trade Desk in a research report on Tuesday, July 15th. Arete Research upgraded shares of Trade Desk to a "strong sell" rating in a report on Monday, July 28th. BMO Capital Markets set a $98.00 price target on shares of Trade Desk and gave the company an "outperform" rating in a report on Friday, August 8th. Piper Sandler reduced their price target on shares of Trade Desk from $65.00 to $64.00 and set a "neutral" rating for the company in a report on Friday, August 8th. Finally, BTIG Research lowered shares of Trade Desk from a "buy" rating to a "neutral" rating in a report on Friday, August 8th. Three investment analysts have rated the stock with a sell rating, twelve have issued a hold rating and twenty-one have issued a buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $89.33.

Get Our Latest Stock Analysis on Trade Desk

Trade Desk Stock Down 0.8%

NASDAQ TTD traded down $0.43 on Monday, reaching $52.84. The company had a trading volume of 3,282,941 shares, compared to its average volume of 11,014,125. Trade Desk has a 12 month low of $42.96 and a 12 month high of $141.53. The stock has a market capitalization of $25.97 billion, a PE ratio of 63.79, a price-to-earnings-growth ratio of 2.74 and a beta of 1.37. The firm's 50 day moving average price is $75.45 and its 200 day moving average price is $72.10.

Trade Desk (NASDAQ:TTD - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The technology company reported $0.18 EPS for the quarter, missing analysts' consensus estimates of $0.42 by ($0.24). Trade Desk had a return on equity of 15.19% and a net margin of 15.57%. The business had revenue of $694.04 million during the quarter, compared to analysts' expectations of $686.00 million. During the same period in the previous year, the business earned $0.39 earnings per share. The business's quarterly revenue was up 18.7% on a year-over-year basis. On average, research analysts expect that Trade Desk will post 1.06 EPS for the current year.

Insider Buying and Selling at Trade Desk

In related news, insider Jay R. Grant sold 51,290 shares of Trade Desk stock in a transaction that occurred on Thursday, August 7th. The shares were sold at an average price of $91.18, for a total value of $4,676,622.20. Following the completion of the transaction, the insider owned 218,246 shares in the company, valued at $19,899,670.28. The trade was a 19.03% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 10.00% of the stock is owned by insiders.

Institutional Investors Weigh In On Trade Desk

A number of large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. increased its position in Trade Desk by 0.7% during the 2nd quarter. Vanguard Group Inc. now owns 44,554,852 shares of the technology company's stock worth $3,207,504,000 after purchasing an additional 317,107 shares in the last quarter. Jennison Associates LLC increased its position in Trade Desk by 17.9% during the 2nd quarter. Jennison Associates LLC now owns 14,267,457 shares of the technology company's stock worth $1,027,114,000 after purchasing an additional 2,169,252 shares in the last quarter. Geode Capital Management LLC increased its position in Trade Desk by 52.1% during the 2nd quarter. Geode Capital Management LLC now owns 12,314,817 shares of the technology company's stock worth $884,860,000 after purchasing an additional 4,218,975 shares in the last quarter. Brown Advisory Inc. increased its position in Trade Desk by 198.4% during the 1st quarter. Brown Advisory Inc. now owns 8,102,294 shares of the technology company's stock worth $443,358,000 after purchasing an additional 5,387,339 shares in the last quarter. Finally, Bank of America Corp DE increased its position in Trade Desk by 13.2% during the 4th quarter. Bank of America Corp DE now owns 3,591,849 shares of the technology company's stock worth $422,150,000 after purchasing an additional 418,911 shares in the last quarter. 67.77% of the stock is owned by institutional investors and hedge funds.

About Trade Desk

(

Get Free Report)

The Trade Desk, Inc operates as a technology company in the United States and internationally. The company offers a self-service cloud-based platform that allows buyers to plan, manage, optimize, and measure data-driven digital advertising campaigns across various ad formats and channels, including video, display, audio, digital-out-of-home, native, and social on various devices, such as computers, mobile devices, televisions, and streaming devices.

Recommended Stories

Before you consider Trade Desk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trade Desk wasn't on the list.

While Trade Desk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.