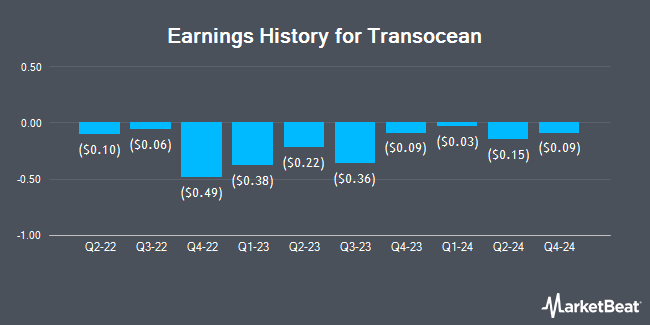

Transocean (NYSE:RIG - Get Free Report) is projected to release its Q1 2025 earnings data after the market closes on Monday, April 28th. Analysts expect Transocean to post earnings of ($0.12) per share and revenue of $884.92 million for the quarter.

Transocean (NYSE:RIG - Get Free Report) last announced its quarterly earnings results on Monday, April 28th. The offshore drilling services provider reported ($0.10) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.12) by $0.02. Transocean had a negative net margin of 14.53% and a negative return on equity of 0.52%. The company had revenue of $906.00 million during the quarter, compared to the consensus estimate of $884.92 million. During the same quarter in the previous year, the company posted ($0.03) earnings per share. The company's revenue for the quarter was up 18.7% compared to the same quarter last year. On average, analysts expect Transocean to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Transocean Stock Performance

Shares of RIG stock traded up $0.21 during trading hours on Thursday, reaching $2.34. The stock had a trading volume of 50,406,897 shares, compared to its average volume of 24,727,148. The company has a debt-to-equity ratio of 0.60, a current ratio of 1.47 and a quick ratio of 1.34. The firm has a 50-day simple moving average of $2.69 and a 200-day simple moving average of $3.54. The firm has a market capitalization of $2.06 billion, a PE ratio of -3.20, a price-to-earnings-growth ratio of 0.86 and a beta of 2.29. Transocean has a twelve month low of $1.97 and a twelve month high of $6.38.

Insider Buying and Selling at Transocean

In other news, EVP Roderick James Mackenzie sold 22,000 shares of Transocean stock in a transaction that occurred on Friday, April 11th. The shares were sold at an average price of $2.23, for a total value of $49,060.00. Following the transaction, the executive vice president now directly owns 362,841 shares of the company's stock, valued at $809,135.43. This trade represents a 5.72 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 13.16% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

RIG has been the subject of several analyst reports. Morgan Stanley reduced their price objective on Transocean from $5.00 to $4.00 and set an "equal weight" rating for the company in a research report on Thursday, March 27th. Evercore ISI cut Transocean from an "outperform" rating to an "in-line" rating and decreased their price target for the stock from $6.00 to $5.00 in a research note on Wednesday, January 15th. Susquehanna reduced their price objective on shares of Transocean from $5.00 to $4.00 and set a "positive" rating for the company in a report on Monday, April 14th. Citigroup decreased their target price on shares of Transocean from $4.50 to $3.50 and set a "neutral" rating for the company in a research report on Wednesday, March 19th. Finally, Barclays dropped their price target on shares of Transocean from $4.00 to $3.50 and set an "overweight" rating on the stock in a research report on Monday, April 7th. One investment analyst has rated the stock with a sell rating, six have given a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $4.59.

Get Our Latest Stock Report on RIG

Transocean Company Profile

(

Get Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Further Reading

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.