TriMas (NASDAQ:TRS - Get Free Report) is anticipated to announce its Q3 2025 results before the market opens on Tuesday, October 28th. Analysts expect the company to announce earnings of $0.57 per share and revenue of $262.0540 million for the quarter. TriMas has set its FY 2025 guidance at 1.950-2.100 EPS.Investors may review the information on the company's upcoming Q3 2025 earningreport for the latest details on the call scheduled for Tuesday, October 28, 2025 at 10:00 AM ET.

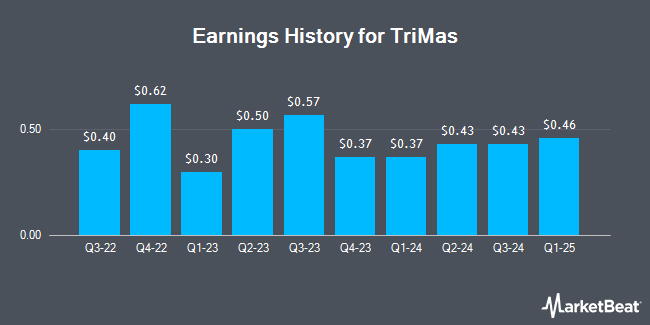

TriMas (NASDAQ:TRS - Get Free Report) last posted its quarterly earnings results on Tuesday, July 29th. The industrial products company reported $0.61 EPS for the quarter, beating the consensus estimate of $0.50 by $0.11. The business had revenue of $274.76 million during the quarter, compared to analyst estimates of $251.18 million. TriMas had a net margin of 3.83% and a return on equity of 11.49%. The company's quarterly revenue was up 14.2% on a year-over-year basis. During the same period in the previous year, the business posted $0.43 EPS. On average, analysts expect TriMas to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

TriMas Trading Up 2.5%

Shares of NASDAQ:TRS opened at $37.83 on Tuesday. The company has a market cap of $1.54 billion, a PE ratio of 41.57 and a beta of 0.62. The company's 50-day moving average price is $38.04 and its 200 day moving average price is $30.80. TriMas has a fifty-two week low of $19.33 and a fifty-two week high of $40.34. The company has a quick ratio of 1.44, a current ratio of 2.59 and a debt-to-equity ratio of 0.59.

Analyst Upgrades and Downgrades

Several analysts recently weighed in on TRS shares. Zacks Research upgraded shares of TriMas from a "hold" rating to a "strong-buy" rating in a research report on Friday, August 29th. KeyCorp set a $45.00 price objective on shares of TriMas and gave the company an "overweight" rating in a research report on Tuesday, August 12th. Weiss Ratings reiterated a "hold (c)" rating on shares of TriMas in a research report on Wednesday, October 8th. Finally, BWS Financial reiterated a "buy" rating and issued a $45.00 price objective (up from $40.00) on shares of TriMas in a research report on Wednesday, July 30th. One research analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and a consensus target price of $45.00.

Read Our Latest Research Report on TRS

Institutional Trading of TriMas

A number of hedge funds and other institutional investors have recently made changes to their positions in the stock. Bank of America Corp DE raised its position in shares of TriMas by 0.3% during the 2nd quarter. Bank of America Corp DE now owns 3,660,001 shares of the industrial products company's stock worth $104,713,000 after buying an additional 9,602 shares in the last quarter. Squarepoint Ops LLC grew its stake in shares of TriMas by 83.3% in the 2nd quarter. Squarepoint Ops LLC now owns 162,775 shares of the industrial products company's stock worth $4,657,000 after purchasing an additional 73,960 shares during the last quarter. Sei Investments Co. grew its stake in shares of TriMas by 16.7% in the 2nd quarter. Sei Investments Co. now owns 101,420 shares of the industrial products company's stock worth $2,902,000 after purchasing an additional 14,512 shares during the last quarter. Lazard Asset Management LLC grew its stake in shares of TriMas by 4,559.3% in the 2nd quarter. Lazard Asset Management LLC now owns 101,154 shares of the industrial products company's stock worth $2,894,000 after purchasing an additional 98,983 shares during the last quarter. Finally, Jump Financial LLC grew its stake in shares of TriMas by 80.3% in the 2nd quarter. Jump Financial LLC now owns 72,240 shares of the industrial products company's stock worth $2,067,000 after purchasing an additional 32,172 shares during the last quarter. 99.42% of the stock is currently owned by institutional investors.

TriMas Company Profile

(

Get Free Report)

TriMas Corporation engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide. The company operates through Packaging, Aerospace, and Specialty Products segments. The Packaging segment offers dispensing products, such as foaming and sanitizer pumps, lotion and hand soap pumps, beverage dispensers, perfume sprayers, and nasal and trigger sprayers; polymeric and steel caps and closures comprising food lids, flip-top and beverage closures, child resistance caps, drum and pail closures, and flexible spouts; polymeric jar products; integrated dispensers; bag-in-box products; and consumable vascular delivery and diagnostic test components under the Rieke, Taplast, Affaba & Ferrari, Intertech, Omega, and Rapak brands.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TriMas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TriMas wasn't on the list.

While TriMas currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.