Triple Flag Precious Metals (NYSE:TFPM - Get Free Report) was downgraded by equities researchers at Canaccord Genuity Group from a "strong-buy" rating to a "hold" rating in a report issued on Thursday,Zacks.com reports.

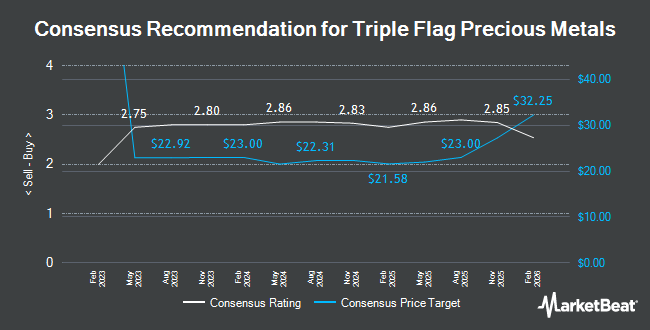

Several other equities analysts also recently issued reports on the company. TD Securities reiterated a "buy" rating on shares of Triple Flag Precious Metals in a research report on Tuesday, June 24th. Zacks Research raised Triple Flag Precious Metals from a "hold" rating to a "strong-buy" rating in a research note on Thursday, September 25th. Weiss Ratings reissued a "buy (b)" rating on shares of Triple Flag Precious Metals in a research note on Saturday, September 27th. Royal Bank Of Canada lifted their target price on Triple Flag Precious Metals from $19.00 to $23.00 and gave the company a "sector perform" rating in a research note on Wednesday, June 4th. Finally, BMO Capital Markets cut Triple Flag Precious Metals from an "outperform" rating to a "market perform" rating in a research note on Wednesday, June 25th. Two analysts have rated the stock with a Strong Buy rating, five have given a Buy rating and four have assigned a Hold rating to the stock. According to MarketBeat.com, Triple Flag Precious Metals has an average rating of "Moderate Buy" and an average price target of $24.00.

View Our Latest Report on Triple Flag Precious Metals

Triple Flag Precious Metals Stock Performance

Shares of TFPM opened at $29.77 on Thursday. The stock has a fifty day moving average price of $26.90 and a two-hundred day moving average price of $23.68. Triple Flag Precious Metals has a 52-week low of $14.51 and a 52-week high of $30.44. The company has a market cap of $6.15 billion, a price-to-earnings ratio of 34.61, a PEG ratio of 1.26 and a beta of -0.18.

Triple Flag Precious Metals (NYSE:TFPM - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported $0.24 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.21 by $0.03. Triple Flag Precious Metals had a return on equity of 8.81% and a net margin of 53.11%.The firm had revenue of $94.09 million during the quarter, compared to the consensus estimate of $82.76 million. As a group, research analysts predict that Triple Flag Precious Metals will post 0.71 EPS for the current fiscal year.

Institutional Investors Weigh In On Triple Flag Precious Metals

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Arrowstreet Capital Limited Partnership increased its holdings in Triple Flag Precious Metals by 67.4% in the second quarter. Arrowstreet Capital Limited Partnership now owns 2,097,794 shares of the company's stock valued at $49,731,000 after purchasing an additional 844,765 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its holdings in shares of Triple Flag Precious Metals by 14.5% in the second quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 1,888,643 shares of the company's stock worth $44,694,000 after acquiring an additional 239,670 shares in the last quarter. Norges Bank bought a new stake in shares of Triple Flag Precious Metals in the second quarter worth about $24,816,000. Mackenzie Financial Corp increased its holdings in shares of Triple Flag Precious Metals by 15.5% in the second quarter. Mackenzie Financial Corp now owns 964,756 shares of the company's stock worth $22,891,000 after acquiring an additional 129,516 shares in the last quarter. Finally, SCS Capital Management LLC bought a new stake in shares of Triple Flag Precious Metals in the first quarter worth about $15,179,000. Institutional investors own 82.91% of the company's stock.

Triple Flag Precious Metals Company Profile

(

Get Free Report)

Triple Flag Precious Metals Corp., a precious-metals-focused streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties and other mineral interests in Australia, Canada, Colombia, Cote d'Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, the United States, and internationally.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Triple Flag Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Triple Flag Precious Metals wasn't on the list.

While Triple Flag Precious Metals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.