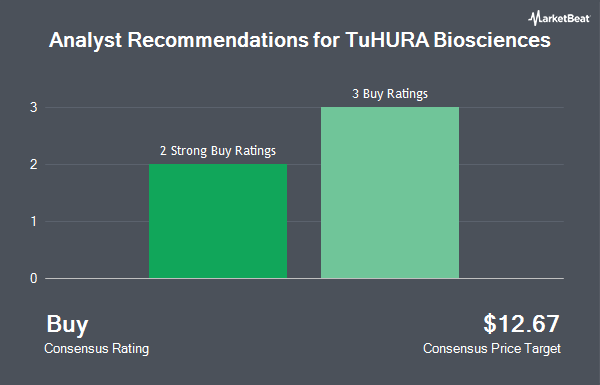

TuHURA Biosciences, Inc. (NASDAQ:HURA - Get Free Report) has received an average rating of "Buy" from the five ratings firms that are presently covering the firm, Marketbeat Ratings reports. Three equities research analysts have rated the stock with a buy recommendation and two have assigned a strong buy recommendation to the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $12.67.

A number of research analysts have recently issued reports on the stock. HC Wainwright restated a "buy" rating and issued a $12.00 price target on shares of TuHURA Biosciences in a research report on Friday, May 16th. Brookline Capital Management raised shares of TuHURA Biosciences to a "strong-buy" rating in a research report on Monday. Finally, Wall Street Zen downgraded TuHURA Biosciences from a "hold" rating to a "sell" rating in a report on Saturday, June 14th.

Read Our Latest Analysis on TuHURA Biosciences

TuHURA Biosciences Price Performance

Shares of NASDAQ:HURA traded down $0.13 during mid-day trading on Tuesday, reaching $2.17. 248,953 shares of the company's stock were exchanged, compared to its average volume of 244,150. TuHURA Biosciences has a twelve month low of $1.80 and a twelve month high of $7.93. The business's fifty day moving average price is $3.31 and its 200-day moving average price is $3.69.

TuHURA Biosciences (NASDAQ:HURA - Get Free Report) last announced its earnings results on Thursday, May 15th. The company reported ($0.15) EPS for the quarter, missing the consensus estimate of ($0.13) by ($0.02).

Institutional Trading of TuHURA Biosciences

Hedge funds have recently made changes to their positions in the company. Accent Capital Management LLC purchased a new stake in TuHURA Biosciences in the 4th quarter worth about $29,000. TT Capital Management LLC bought a new position in TuHURA Biosciences during the fourth quarter worth about $41,000. Jefferies Financial Group Inc. purchased a new position in shares of TuHURA Biosciences in the fourth quarter worth about $54,000. Bank of America Corp DE purchased a new position in shares of TuHURA Biosciences in the fourth quarter worth about $59,000. Finally, Charles Schwab Investment Management Inc. bought a new stake in shares of TuHURA Biosciences in the fourth quarter valued at approximately $61,000. 0.62% of the stock is currently owned by institutional investors.

TuHURA Biosciences Company Profile

(

Get Free ReportTuHURA Biosciences, Inc NASDAQ: HURA is a Phase 3 registration-stage immuno-oncology company developing novel technologies to overcome resistance to cancer immunotherapy. TuHURA's lead innate immune response agonist candidate, IFx-2.0, is designed to overcome primary resistance to checkpoint inhibitors.

Featured Articles

Before you consider TuHURA Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TuHURA Biosciences wasn't on the list.

While TuHURA Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for July 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.