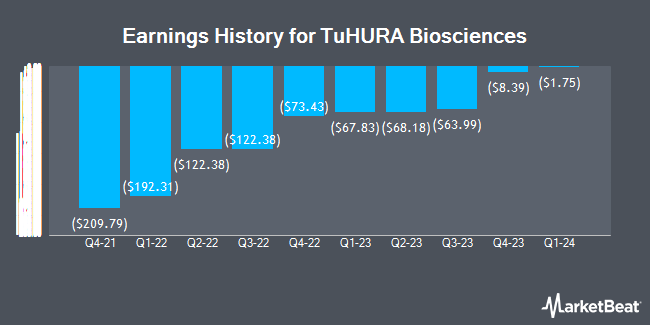

TuHURA Biosciences (NASDAQ:HURA - Get Free Report) announced its quarterly earnings results on Thursday, August 14th. The company reported ($0.21) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.14) by ($0.07), Zacks reports.

TuHURA Biosciences Trading Down 2.3%

NASDAQ:HURA traded down $0.07 during trading hours on Thursday, reaching $2.91. The company had a trading volume of 196,273 shares, compared to its average volume of 769,473. The business's 50-day simple moving average is $2.60 and its two-hundred day simple moving average is $3.15. TuHURA Biosciences has a twelve month low of $1.80 and a twelve month high of $8.40.

Wall Street Analyst Weigh In

HURA has been the subject of several recent research reports. Wall Street Zen upgraded shares of TuHURA Biosciences from a "sell" rating to a "hold" rating in a research report on Friday, July 18th. Brookline Capital Management upgraded shares of TuHURA Biosciences to a "strong-buy" rating in a research report on Monday, June 23rd. Finally, HC Wainwright restated a "buy" rating and issued a $12.00 price target on shares of TuHURA Biosciences in a research report on Friday, May 16th. Two research analysts have rated the stock with a Strong Buy rating and three have issued a Buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and an average target price of $12.67.

View Our Latest Analysis on HURA

Institutional Investors Weigh In On TuHURA Biosciences

Large investors have recently bought and sold shares of the stock. JPMorgan Chase & Co. acquired a new stake in TuHURA Biosciences in the second quarter worth $27,000. Invesco Ltd. bought a new position in shares of TuHURA Biosciences in the second quarter valued at $30,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. bought a new position in shares of TuHURA Biosciences in the second quarter valued at $31,000. Bank of America Corp DE bought a new position in shares of TuHURA Biosciences in the fourth quarter valued at $59,000. Finally, Jane Street Group LLC bought a new position in shares of TuHURA Biosciences in the first quarter valued at $69,000. 0.62% of the stock is currently owned by institutional investors and hedge funds.

About TuHURA Biosciences

(

Get Free Report)

TuHURA Biosciences, Inc NASDAQ: HURA is a Phase 3 registration-stage immuno-oncology company developing novel technologies to overcome resistance to cancer immunotherapy. TuHURA's lead innate immune response agonist candidate, IFx-2.0, is designed to overcome primary resistance to checkpoint inhibitors.

Further Reading

Before you consider TuHURA Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TuHURA Biosciences wasn't on the list.

While TuHURA Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.