Hexcel (NYSE:HXL - Get Free Report) had its target price increased by investment analysts at UBS Group from $60.00 to $65.00 in a research report issued on Monday,Benzinga reports. The firm presently has a "neutral" rating on the aerospace company's stock. UBS Group's target price points to a potential upside of 9.93% from the company's current price.

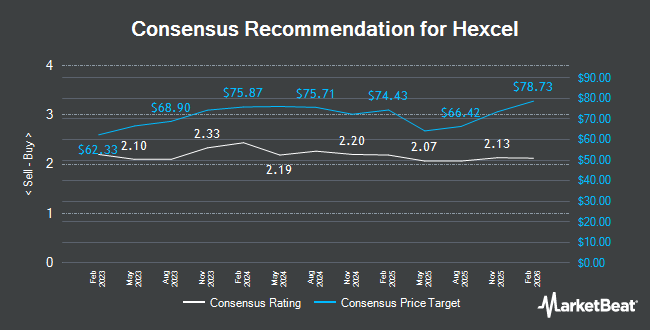

Other equities research analysts have also issued research reports about the stock. BMO Capital Markets reduced their price objective on shares of Hexcel from $72.00 to $52.00 and set a "market perform" rating for the company in a research note on Wednesday, April 23rd. Truist Financial dropped their price target on shares of Hexcel from $73.00 to $67.00 and set a "buy" rating for the company in a research report on Wednesday, April 23rd. Wall Street Zen cut shares of Hexcel from a "buy" rating to a "hold" rating in a research note on Sunday, April 27th. Wells Fargo & Company decreased their price target on shares of Hexcel from $55.00 to $53.00 and set an "equal weight" rating on the stock in a research note on Thursday, April 24th. Finally, Morgan Stanley increased their price target on shares of Hexcel from $50.00 to $55.00 and gave the company an "underweight" rating in a research note on Thursday, July 17th. One research analyst has rated the stock with a sell rating, eight have given a hold rating and two have given a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $63.33.

View Our Latest Research Report on HXL

Hexcel Trading Down 1.3%

NYSE HXL traded down $0.78 on Monday, hitting $59.13. 273,585 shares of the stock were exchanged, compared to its average volume of 1,206,929. Hexcel has a 52-week low of $45.28 and a 52-week high of $71.05. The company has a debt-to-equity ratio of 0.53, a current ratio of 2.69 and a quick ratio of 1.50. The company has a market capitalization of $4.70 billion, a price-to-earnings ratio of 54.75, a P/E/G ratio of 2.01 and a beta of 1.28. The company's 50-day moving average price is $57.03 and its two-hundred day moving average price is $57.53.

Hexcel (NYSE:HXL - Get Free Report) last posted its quarterly earnings data on Thursday, July 24th. The aerospace company reported $0.50 earnings per share for the quarter, topping the consensus estimate of $0.46 by $0.04. Hexcel had a net margin of 4.69% and a return on equity of 9.76%. The firm had revenue of $489.90 million for the quarter, compared to analysts' expectations of $482.20 million. During the same period in the previous year, the company posted $0.60 EPS. The company's quarterly revenue was down 2.1% compared to the same quarter last year. Research analysts predict that Hexcel will post 2.14 EPS for the current year.

Institutional Inflows and Outflows

Hedge funds have recently added to or reduced their stakes in the business. Trust Co. of Toledo NA OH bought a new position in shares of Hexcel in the 2nd quarter valued at about $26,000. Park Place Capital Corp boosted its holdings in shares of Hexcel by 65.1% during the 2nd quarter. Park Place Capital Corp now owns 497 shares of the aerospace company's stock worth $28,000 after buying an additional 196 shares during the period. Geneos Wealth Management Inc. raised its stake in Hexcel by 138.7% in the 1st quarter. Geneos Wealth Management Inc. now owns 759 shares of the aerospace company's stock worth $42,000 after purchasing an additional 441 shares in the last quarter. Oliver Lagore Vanvalin Investment Group bought a new stake in Hexcel in the 2nd quarter valued at about $55,000. Finally, Parvin Asset Management LLC bought a new stake in Hexcel in the 4th quarter valued at about $66,000. Institutional investors own 95.47% of the company's stock.

About Hexcel

(

Get Free Report)

Hexcel Corporation develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications. It operates through two segments, Composite Materials and Engineered Products.

Recommended Stories

Before you consider Hexcel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hexcel wasn't on the list.

While Hexcel currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.