IQVIA (NYSE:IQV - Free Report) had its price objective boosted by UBS Group from $185.00 to $225.00 in a report released on Wednesday morning,Benzinga reports. They currently have a buy rating on the medical research company's stock.

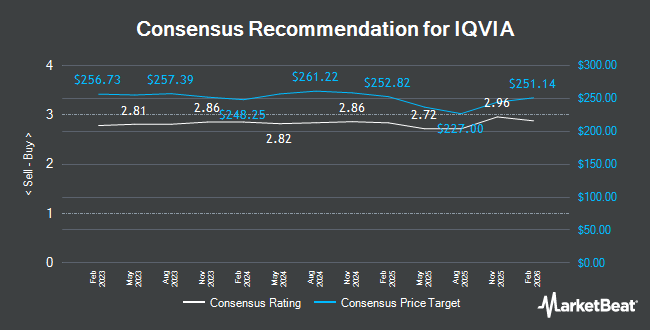

Other equities analysts have also recently issued reports about the company. Citigroup reiterated a "neutral" rating on shares of IQVIA in a research note on Thursday, May 22nd. Mizuho lowered their price target on IQVIA from $210.00 to $190.00 and set an "outperform" rating on the stock in a report on Thursday, May 15th. Evercore ISI raised their target price on IQVIA from $170.00 to $180.00 and gave the company an "outperform" rating in a research note on Wednesday, July 9th. Cowen reiterated a "buy" rating on shares of IQVIA in a research report on Wednesday. Finally, Redburn Partners set a $188.00 price target on IQVIA in a research note on Friday, May 23rd. Seven investment analysts have rated the stock with a hold rating, seventeen have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $226.95.

View Our Latest Research Report on IQV

IQVIA Trading Down 1.5%

NYSE:IQV traded down $2.98 on Wednesday, reaching $197.84. The stock had a trading volume of 1,057,557 shares, compared to its average volume of 2,035,858. The company has a market cap of $33.63 billion, a price-to-earnings ratio of 28.58, a P/E/G ratio of 2.29 and a beta of 1.30. The company has a debt-to-equity ratio of 2.45, a current ratio of 0.84 and a quick ratio of 0.82. The firm's fifty day moving average is $155.96 and its two-hundred day moving average is $170.53. IQVIA has a 12-month low of $134.65 and a 12-month high of $252.88.

IQVIA (NYSE:IQV - Get Free Report) last posted its quarterly earnings data on Tuesday, July 22nd. The medical research company reported $2.81 EPS for the quarter, beating analysts' consensus estimates of $2.77 by $0.04. The company had revenue of $4.02 billion during the quarter, compared to the consensus estimate of $3.96 billion. IQVIA had a net margin of 7.88% and a return on equity of 30.05%. The company's quarterly revenue was up 5.3% compared to the same quarter last year. During the same quarter in the prior year, the company posted $2.64 EPS. Equities analysts expect that IQVIA will post 10.84 EPS for the current fiscal year.

Institutional Trading of IQVIA

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in IQV. Brighton Jones LLC increased its holdings in IQVIA by 244.4% during the 4th quarter. Brighton Jones LLC now owns 3,575 shares of the medical research company's stock worth $703,000 after purchasing an additional 2,537 shares in the last quarter. Sei Investments Co. increased its holdings in IQVIA by 4.7% during the 4th quarter. Sei Investments Co. now owns 86,503 shares of the medical research company's stock worth $16,999,000 after purchasing an additional 3,844 shares in the last quarter. LPL Financial LLC boosted its stake in shares of IQVIA by 1.4% in the 4th quarter. LPL Financial LLC now owns 96,506 shares of the medical research company's stock worth $18,964,000 after buying an additional 1,311 shares during the last quarter. EntryPoint Capital LLC purchased a new position in shares of IQVIA in the 4th quarter worth approximately $276,000. Finally, Zions Bancorporation N.A. boosted its stake in shares of IQVIA by 55.2% in the 4th quarter. Zions Bancorporation N.A. now owns 239 shares of the medical research company's stock worth $47,000 after buying an additional 85 shares during the last quarter. 89.62% of the stock is owned by institutional investors.

About IQVIA

(

Get Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Articles

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.