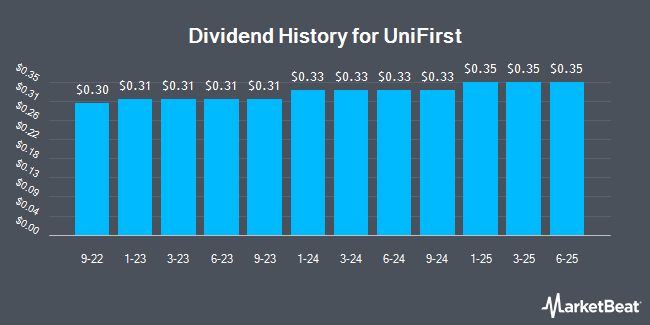

Unifirst Corporation (NYSE:UNF - Get Free Report) announced a quarterly dividend on Tuesday, July 29th, RTT News reports. Shareholders of record on Friday, September 5th will be paid a dividend of 0.35 per share by the textile maker on Friday, September 26th. This represents a c) dividend on an annualized basis and a yield of 0.8%. The ex-dividend date is Friday, September 5th.

Unifirst has a dividend payout ratio of 16.2% indicating that its dividend is sufficiently covered by earnings. Analysts expect Unifirst to earn $8.68 per share next year, which means the company should continue to be able to cover its $1.40 annual dividend with an expected future payout ratio of 16.1%.

Unifirst Price Performance

Shares of NYSE:UNF traded down $1.44 during midday trading on Friday, hitting $169.59. The company had a trading volume of 142,703 shares, compared to its average volume of 127,382. The company has a market cap of $3.14 billion, a price-to-earnings ratio of 20.83 and a beta of 0.85. Unifirst has a 12-month low of $156.34 and a 12-month high of $243.70. The company has a fifty day moving average of $180.86 and a two-hundred day moving average of $190.83.

Unifirst (NYSE:UNF - Get Free Report) last released its quarterly earnings data on Wednesday, July 2nd. The textile maker reported $2.13 EPS for the quarter, beating the consensus estimate of $2.09 by $0.04. Unifirst had a net margin of 6.18% and a return on equity of 7.35%. The business had revenue of $610.78 million during the quarter, compared to the consensus estimate of $614.50 million. During the same quarter in the prior year, the firm earned $2.20 EPS. The business's revenue was up 1.2% on a year-over-year basis. Research analysts expect that Unifirst will post 7.71 earnings per share for the current fiscal year.

Unifirst announced that its Board of Directors has authorized a stock buyback plan on Tuesday, April 8th that permits the company to repurchase $100.00 million in shares. This repurchase authorization permits the textile maker to repurchase up to 3.3% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's leadership believes its shares are undervalued.

About Unifirst

(

Get Free Report)

UniFirst Corporation provides workplace uniforms and protective work wear clothing in the United States, Europe, and Canada. The company operates through U.S. and Canadian Rental and Cleaning, Manufacturing, Specialty Garments Rental and Cleaning, and First Aid segments. It designs, manufactures, personalizes, rents, cleans, delivers, and sells a range of uniforms and protective clothing, including shirts, pants, jackets, coveralls, lab coats, smocks, and aprons; and specialized protective wear, such as flame resistant and high visibility garments.

Featured Stories

Before you consider Unifirst, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unifirst wasn't on the list.

While Unifirst currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.