United Therapeutics (NASDAQ:UTHR - Get Free Report) is expected to be releasing its Q3 2025 results before the market opens on Wednesday, October 29th. Analysts expect United Therapeutics to post earnings of $6.75 per share and revenue of $812.8730 million for the quarter. Interested persons are encouraged to explore the company's upcoming Q3 2025 earningoverview page for the latest details on the call scheduled for Wednesday, October 29, 2025 at 9:00 AM ET.

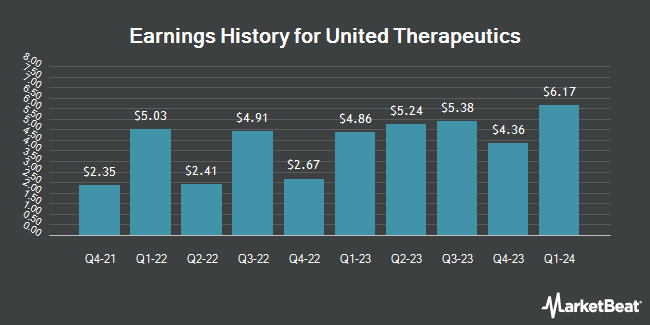

United Therapeutics (NASDAQ:UTHR - Get Free Report) last announced its quarterly earnings results on Wednesday, July 30th. The biotechnology company reported $6.41 EPS for the quarter, missing analysts' consensus estimates of $6.80 by ($0.39). United Therapeutics had a net margin of 40.36% and a return on equity of 18.73%. The company had revenue of $798.60 million during the quarter, compared to analyst estimates of $802.13 million. During the same quarter last year, the company posted $5.85 EPS. The firm's quarterly revenue was up 11.7% on a year-over-year basis. On average, analysts expect United Therapeutics to post $24 EPS for the current fiscal year and $27 EPS for the next fiscal year.

United Therapeutics Stock Performance

Shares of UTHR opened at $422.53 on Wednesday. United Therapeutics has a 52 week low of $266.98 and a 52 week high of $459.48. The firm has a market cap of $19.06 billion, a P/E ratio of 16.49, a price-to-earnings-growth ratio of 4.72 and a beta of 0.66. The firm's 50-day simple moving average is $390.76 and its 200 day simple moving average is $329.82.

Insider Transactions at United Therapeutics

In other news, CEO Martine A. Rothblatt sold 4,000 shares of the company's stock in a transaction that occurred on Monday, October 20th. The shares were sold at an average price of $424.59, for a total transaction of $1,698,360.00. Following the completion of the sale, the chief executive officer owned 130 shares of the company's stock, valued at approximately $55,196.70. This represents a 96.85% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, EVP Paul A. Mahon sold 11,000 shares of the company's stock in a transaction that occurred on Thursday, October 16th. The stock was sold at an average price of $431.50, for a total transaction of $4,746,500.00. Following the sale, the executive vice president directly owned 36,781 shares of the company's stock, valued at approximately $15,871,001.50. This trade represents a 23.02% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 329,935 shares of company stock valued at $135,017,892. Company insiders own 10.30% of the company's stock.

Institutional Trading of United Therapeutics

A number of institutional investors and hedge funds have recently made changes to their positions in the company. Rakuten Securities Inc. lifted its stake in United Therapeutics by 76.7% in the 2nd quarter. Rakuten Securities Inc. now owns 106 shares of the biotechnology company's stock valued at $30,000 after purchasing an additional 46 shares during the last quarter. WealthCollab LLC boosted its position in United Therapeutics by 55.9% in the second quarter. WealthCollab LLC now owns 106 shares of the biotechnology company's stock valued at $30,000 after buying an additional 38 shares in the last quarter. Geneos Wealth Management Inc. boosted its position in United Therapeutics by 141.7% in the first quarter. Geneos Wealth Management Inc. now owns 145 shares of the biotechnology company's stock valued at $45,000 after buying an additional 85 shares in the last quarter. State of Wyoming acquired a new stake in United Therapeutics in the second quarter valued at approximately $55,000. Finally, Northwestern Mutual Wealth Management Co. boosted its position in United Therapeutics by 18.8% in the second quarter. Northwestern Mutual Wealth Management Co. now owns 443 shares of the biotechnology company's stock valued at $127,000 after buying an additional 70 shares in the last quarter. Institutional investors own 94.08% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have issued reports on UTHR. Bank of America increased their target price on shares of United Therapeutics from $314.00 to $463.00 and gave the stock a "neutral" rating in a research report on Tuesday, September 2nd. Royal Bank Of Canada began coverage on shares of United Therapeutics in a research report on Friday, September 26th. They set an "outperform" rating and a $569.00 target price on the stock. Oppenheimer increased their target price on shares of United Therapeutics from $510.00 to $575.00 and gave the stock an "outperform" rating in a research report on Friday, September 5th. Cantor Fitzgerald increased their target price on shares of United Therapeutics from $405.00 to $525.00 and gave the stock an "overweight" rating in a research report on Wednesday, September 10th. Finally, Jefferies Financial Group increased their target price on shares of United Therapeutics from $432.00 to $564.00 and gave the stock a "buy" rating in a research report on Tuesday, September 2nd. Nine investment analysts have rated the stock with a Buy rating, four have assigned a Hold rating and one has assigned a Sell rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $461.62.

Read Our Latest Report on UTHR

United Therapeutics Company Profile

(

Get Free Report)

United Therapeutics Corporation, a biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally. The company offers Tyvaso DPI, an inhaled dry powder via pre-filled and single-use cartridges; Tyvaso, an inhaled solution via ultrasonic nebulizer; Remodulin (treprostinil) injection to treat patients with pulmonary arterial hypertension (PAH) to diminish symptoms associated with exercise; Orenitram, a tablet dosage form of treprostinil, to delay disease progression and improve exercise capacity in PAH patients; and Adcirca, an oral PDE-5 inhibitor to enhance the exercise ability in PAH patients.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider United Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Therapeutics wasn't on the list.

While United Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.