Unity Software (NYSE:U - Get Free Report) was upgraded by stock analysts at The Goldman Sachs Group to a "hold" rating in a research note issued on Tuesday,Zacks.com reports.

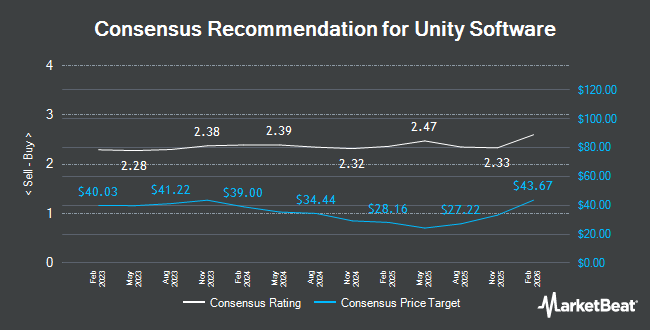

A number of other equities analysts have also recently weighed in on U. Morgan Stanley upped their price target on shares of Unity Software from $25.00 to $40.00 and gave the stock an "overweight" rating in a research note on Thursday, August 7th. Wedbush upped their price target on shares of Unity Software from $41.00 to $42.00 and gave the stock an "outperform" rating in a research note on Monday, October 6th. Barclays upped their price target on shares of Unity Software from $25.00 to $30.00 and gave the stock an "equal weight" rating in a research note on Thursday, August 7th. Bank of America started coverage on shares of Unity Software in a research note on Thursday, June 26th. They issued an "underperform" rating and a $15.00 price objective on the stock. Finally, Hsbc Global Res cut shares of Unity Software from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, September 30th. One investment analyst has rated the stock with a Strong Buy rating, seven have given a Buy rating, ten have assigned a Hold rating and three have given a Sell rating to the stock. Based on data from MarketBeat.com, Unity Software presently has a consensus rating of "Hold" and an average price target of $32.99.

View Our Latest Analysis on Unity Software

Unity Software Stock Performance

NYSE:U opened at $37.39 on Tuesday. The company has a quick ratio of 2.73, a current ratio of 2.73 and a debt-to-equity ratio of 0.70. Unity Software has a fifty-two week low of $15.33 and a fifty-two week high of $46.94. The stock has a market cap of $15.80 billion, a PE ratio of -35.28 and a beta of 2.32. The firm's fifty day simple moving average is $40.11 and its 200-day simple moving average is $29.90.

Unity Software (NYSE:U - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The company reported ($0.26) earnings per share for the quarter, missing analysts' consensus estimates of ($0.25) by ($0.01). Unity Software had a negative return on equity of 13.59% and a negative net margin of 24.38%.The company had revenue of $440.94 million for the quarter, compared to analyst estimates of $425.18 million. During the same period last year, the company earned ($0.32) earnings per share. The business's revenue for the quarter was down 1.9% compared to the same quarter last year. Analysts expect that Unity Software will post -1.25 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Unity Software news, COO Alexander Blum sold 63,813 shares of the company's stock in a transaction dated Wednesday, August 27th. The shares were sold at an average price of $39.41, for a total value of $2,514,870.33. Following the transaction, the chief operating officer directly owned 603,811 shares in the company, valued at approximately $23,796,191.51. This represents a 9.56% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Tomer Bar-Zeev sold 250,000 shares of the company's stock in a transaction dated Wednesday, October 1st. The shares were sold at an average price of $39.83, for a total transaction of $9,957,500.00. Following the completion of the transaction, the director owned 1,548,146 shares in the company, valued at approximately $61,662,655.18. This trade represents a 13.90% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 2,233,415 shares of company stock worth $94,949,128 in the last 90 days. 3.61% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently added to or reduced their stakes in U. Norges Bank purchased a new position in Unity Software in the 2nd quarter valued at about $151,221,000. Atreides Management LP lifted its holdings in shares of Unity Software by 146.7% during the 1st quarter. Atreides Management LP now owns 9,430,955 shares of the company's stock worth $184,752,000 after acquiring an additional 5,607,572 shares during the period. Slate Path Capital LP lifted its holdings in shares of Unity Software by 25.4% during the 2nd quarter. Slate Path Capital LP now owns 20,016,952 shares of the company's stock worth $484,410,000 after acquiring an additional 4,048,484 shares during the period. Broad Peak Investment Advisers Pte Ltd purchased a new position in shares of Unity Software during the 1st quarter worth about $47,648,000. Finally, Fuller & Thaler Asset Management Inc. purchased a new position in shares of Unity Software during the 1st quarter worth about $43,265,000. 73.46% of the stock is currently owned by hedge funds and other institutional investors.

About Unity Software

(

Get Free Report)

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.