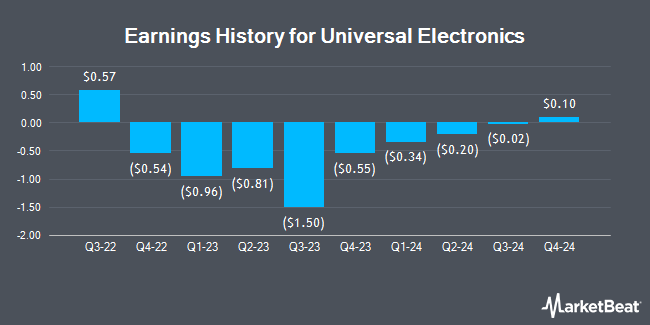

Universal Electronics (NASDAQ:UEIC - Get Free Report) will likely be issuing its Q2 2025 quarterly earnings data after the market closes on Thursday, August 7th. Analysts expect Universal Electronics to post earnings of $0.05 per share and revenue of $94.22 million for the quarter.

Universal Electronics Trading Up 1.6%

Universal Electronics stock traded up $0.10 during mid-day trading on Monday, hitting $6.38. The company had a trading volume of 41,524 shares, compared to its average volume of 64,032. Universal Electronics has a 12 month low of $4.32 and a 12 month high of $12.50. The stock's 50 day moving average price is $6.72 and its two-hundred day moving average price is $7.06. The company has a market capitalization of $84.02 million, a PE ratio of -3.84, a price-to-earnings-growth ratio of 10.47 and a beta of 1.55.

Insider Buying and Selling

In other news, Director Eric Singer acquired 4,200 shares of the firm's stock in a transaction that occurred on Tuesday, June 3rd. The stock was bought at an average cost of $6.62 per share, for a total transaction of $27,804.00. Following the acquisition, the director directly owned 61,297 shares in the company, valued at approximately $405,786.14. The trade was a 7.36% increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through this link. Over the last quarter, insiders have bought 54,780 shares of company stock worth $369,643. Corporate insiders own 9.37% of the company's stock.

Hedge Funds Weigh In On Universal Electronics

A number of hedge funds have recently bought and sold shares of the business. Empowered Funds LLC grew its stake in shares of Universal Electronics by 8.4% in the first quarter. Empowered Funds LLC now owns 48,816 shares of the technology company's stock worth $299,000 after acquiring an additional 3,802 shares during the period. Goldman Sachs Group Inc. boosted its holdings in Universal Electronics by 15.6% in the first quarter. Goldman Sachs Group Inc. now owns 36,341 shares of the technology company's stock worth $222,000 after purchasing an additional 4,893 shares during the last quarter. Finally, Cubist Systematic Strategies LLC grew its position in Universal Electronics by 62.7% in the 1st quarter. Cubist Systematic Strategies LLC now owns 32,502 shares of the technology company's stock worth $199,000 after purchasing an additional 12,526 shares during the period. Hedge funds and other institutional investors own 79.35% of the company's stock.

About Universal Electronics

(

Get Free Report)

Universal Electronics Inc designs, develops, manufactures, ships, and supports control and sensor technology solutions in the United States, the People's Republic of China, rest of Asia, Europe, Latin America, and internationally. The company offers voice-enabled automatically-programmed universal two-way radio frequency, as well as infrared remote controls to video service providers, original equipment manufacturers (OEMs), retailers, and private label customers; wall-mount and handheld thermostat controllers and connected accessories for smart energy management systems to OEM customers, hotels, hospitality, and system integrators; proprietary and standards-based RF sensors for residential security, safety, and home automation applications; and integrated circuits on which its software and universal device control database is embedded to OEMs, video service providers, and private label customers.

See Also

Before you consider Universal Electronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Electronics wasn't on the list.

While Universal Electronics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.