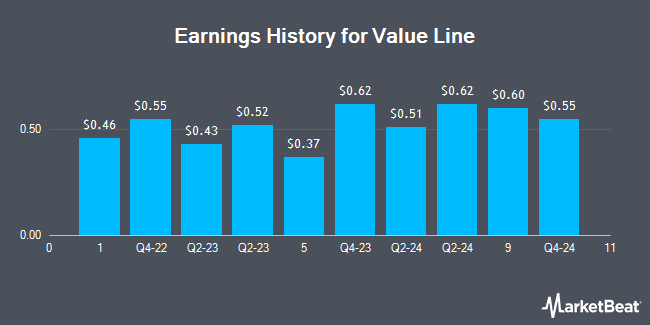

Value Line (NASDAQ:VALU - Get Free Report) posted its quarterly earnings data on Monday. The financial services provider reported $0.69 earnings per share for the quarter, Zacks reports. The business had revenue of $8.61 million during the quarter. Value Line had a return on equity of 21.35% and a net margin of 61.09%.

Value Line Trading Down 1.4%

Shares of Value Line stock traded down $0.54 during trading hours on Friday, hitting $37.98. 7,446 shares of the company were exchanged, compared to its average volume of 6,555. The business has a 50-day moving average of $38.20 and a 200-day moving average of $38.83. The stock has a market capitalization of $357.39 million, a price-to-earnings ratio of 16.81 and a beta of 1.11. Value Line has a 1 year low of $32.94 and a 1 year high of $57.68.

Value Line Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, August 11th. Stockholders of record on Monday, July 28th were paid a dividend of $0.325 per share. This represents a $1.30 annualized dividend and a dividend yield of 3.4%. The ex-dividend date was Monday, July 28th. Value Line's dividend payout ratio is 57.52%.

Analyst Ratings Changes

Separately, Wall Street Zen upgraded Value Line to a "hold" rating in a research note on Saturday, September 13th.

View Our Latest Analysis on VALU

Value Line Company Profile

(

Get Free Report)

Value Line, Inc produces and sells investment periodicals and related publications. Its investment periodicals and related publications cover a range of investments, including stocks, mutual funds, exchange traded funds (ETFs), and options. The company's research services include The Value Line Investment Survey, The Value Line Investment Survey - Small and Mid-Cap, The Value Line 600, and The Value Line Fund Advisor Plus that provide statistical and text coverage of various investment securities, with an emphasis placed on its proprietary research, analysis, and statistical ranks.

Further Reading

Before you consider Value Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Value Line wasn't on the list.

While Value Line currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.