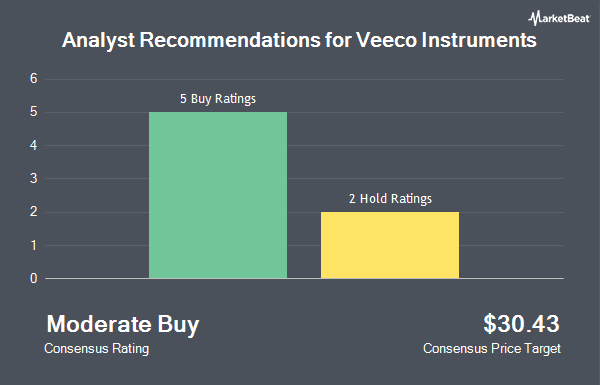

Shares of Veeco Instruments Inc. (NASDAQ:VECO - Get Free Report) have been assigned an average recommendation of "Moderate Buy" from the seven ratings firms that are presently covering the firm, Marketbeat Ratings reports. Two equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company. The average 1 year price target among analysts that have covered the stock in the last year is $30.43.

A number of research analysts recently issued reports on the company. Benchmark decreased their price objective on Veeco Instruments from $38.00 to $31.00 and set a "buy" rating for the company in a report on Thursday, February 13th. Needham & Company LLC reduced their price target on Veeco Instruments from $35.00 to $29.00 and set a "buy" rating for the company in a research report on Thursday, February 13th. The Goldman Sachs Group reduced their price target on Veeco Instruments from $27.00 to $20.00 and set a "neutral" rating for the company in a research report on Friday, May 9th. Wall Street Zen raised Veeco Instruments from a "sell" rating to a "hold" rating in a research report on Friday, February 28th. Finally, Citigroup reduced their price target on Veeco Instruments from $33.00 to $30.00 and set a "buy" rating for the company in a research report on Thursday, February 13th.

Get Our Latest Analysis on Veeco Instruments

Veeco Instruments Trading Up 4.3%

Shares of Veeco Instruments stock traded up $0.88 during trading hours on Friday, hitting $21.45. The company's stock had a trading volume of 882,238 shares, compared to its average volume of 748,681. The company has a debt-to-equity ratio of 0.32, a current ratio of 3.98 and a quick ratio of 2.69. The company has a market capitalization of $1.29 billion, a PE ratio of 17.30 and a beta of 1.11. Veeco Instruments has a 12 month low of $16.92 and a 12 month high of $49.25. The stock has a 50 day moving average of $19.33 and a 200 day moving average of $23.10.

Veeco Instruments (NASDAQ:VECO - Get Free Report) last posted its quarterly earnings data on Wednesday, May 7th. The semiconductor company reported $0.37 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.32 by $0.05. The business had revenue of $167.29 million during the quarter, compared to the consensus estimate of $166.00 million. Veeco Instruments had a return on equity of 9.38% and a net margin of 10.28%. Veeco Instruments's quarterly revenue was down 4.1% on a year-over-year basis. During the same period last year, the company earned $0.45 earnings per share. Analysts predict that Veeco Instruments will post 0.76 earnings per share for the current year.

Insider Activity at Veeco Instruments

In other news, SVP Adrian Devasahayam sold 11,010 shares of the firm's stock in a transaction that occurred on Thursday, June 5th. The stock was sold at an average price of $20.50, for a total value of $225,705.00. Following the completion of the sale, the senior vice president now directly owns 89,254 shares of the company's stock, valued at $1,829,707. This trade represents a 10.98% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Insiders own 2.40% of the company's stock.

Institutional Trading of Veeco Instruments

Hedge funds have recently made changes to their positions in the business. Versant Capital Management Inc lifted its position in shares of Veeco Instruments by 396.2% in the first quarter. Versant Capital Management Inc now owns 1,295 shares of the semiconductor company's stock valued at $26,000 after buying an additional 1,034 shares during the last quarter. Smartleaf Asset Management LLC lifted its holdings in Veeco Instruments by 257.4% during the 4th quarter. Smartleaf Asset Management LLC now owns 1,276 shares of the semiconductor company's stock worth $35,000 after purchasing an additional 919 shares during the last quarter. Brooklyn Investment Group acquired a new stake in Veeco Instruments during the 1st quarter worth approximately $37,000. Signaturefd LLC lifted its holdings in Veeco Instruments by 213.9% during the 1st quarter. Signaturefd LLC now owns 3,139 shares of the semiconductor company's stock worth $63,000 after purchasing an additional 2,139 shares during the last quarter. Finally, US Bancorp DE lifted its holdings in Veeco Instruments by 33.6% during the 1st quarter. US Bancorp DE now owns 3,366 shares of the semiconductor company's stock worth $68,000 after purchasing an additional 847 shares during the last quarter. 98.46% of the stock is owned by institutional investors and hedge funds.

Veeco Instruments Company Profile

(

Get Free ReportVeeco Instruments Inc, together with its subsidiaries, develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices in the United States, Europe, the Middle East, and Africa, China, Rest of the Asia-Pacific, and internationally. The company offers laser annealing, ion beam deposition and etch, metal organic chemical vapor deposition, single wafer wet processing and surface preparation, molecular beam epitaxy, advanced packaging lithography, atomic layer deposition, and other deposition systems.

Further Reading

Before you consider Veeco Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeco Instruments wasn't on the list.

While Veeco Instruments currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.