Vertex (NASDAQ:VERX - Get Free Report) was upgraded by analysts at DA Davidson to a "hold" rating in a report issued on Wednesday,Zacks.com reports.

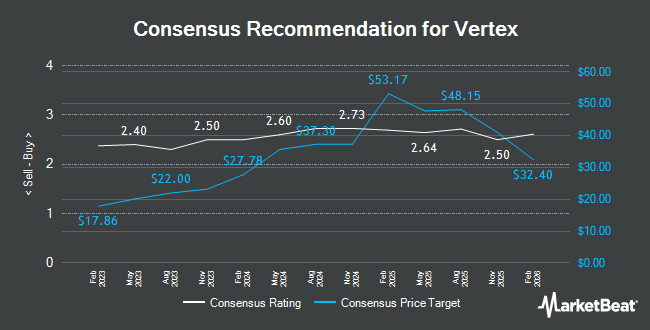

Other equities research analysts also recently issued research reports about the company. Stephens initiated coverage on Vertex in a report on Friday, September 26th. They issued an "overweight" rating and a $30.00 price objective for the company. JMP Securities set a $50.00 price target on shares of Vertex and gave the company a "market outperform" rating in a research report on Thursday, August 7th. Weiss Ratings reiterated a "sell (d)" rating on shares of Vertex in a research report on Wednesday, October 8th. Jefferies Financial Group reiterated a "buy" rating and issued a $35.00 price target on shares of Vertex in a research report on Tuesday. Finally, Bank of America reduced their price target on shares of Vertex from $42.00 to $34.00 and set a "neutral" rating on the stock in a research report on Friday, August 8th. One investment analyst has rated the stock with a Strong Buy rating, nine have assigned a Buy rating, five have given a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat, Vertex currently has a consensus rating of "Moderate Buy" and a consensus price target of $41.79.

Get Our Latest Report on VERX

Vertex Trading Down 0.3%

VERX stock opened at $25.86 on Wednesday. The company has a current ratio of 0.99, a quick ratio of 0.99 and a debt-to-equity ratio of 1.36. The business's 50 day moving average is $25.07 and its 200-day moving average is $32.53. Vertex has a 1-year low of $23.13 and a 1-year high of $60.71. The firm has a market cap of $4.12 billion, a P/E ratio of -78.36, a P/E/G ratio of 5.35 and a beta of 0.63.

Vertex (NASDAQ:VERX - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported $0.15 EPS for the quarter, topping the consensus estimate of $0.14 by $0.01. Vertex had a positive return on equity of 27.16% and a negative net margin of 7.09%.The company had revenue of $184.56 million for the quarter, compared to analysts' expectations of $184.60 million. During the same quarter in the prior year, the business earned $0.15 earnings per share. The business's revenue for the quarter was up 14.6% on a year-over-year basis. Equities analysts anticipate that Vertex will post 0.38 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Vertex

Several large investors have recently made changes to their positions in VERX. Lazard Freres Gestion S.A.S. raised its stake in Vertex by 250.0% in the 3rd quarter. Lazard Freres Gestion S.A.S. now owns 70,000 shares of the company's stock valued at $1,735,000 after acquiring an additional 50,000 shares during the period. Diversified Trust Co boosted its position in shares of Vertex by 26.1% in the third quarter. Diversified Trust Co now owns 23,975 shares of the company's stock valued at $594,000 after acquiring an additional 4,963 shares during the period. Osaic Holdings Inc. raised its stake in Vertex by 108.8% in the 2nd quarter. Osaic Holdings Inc. now owns 5,781 shares of the company's stock worth $204,000 after purchasing an additional 3,012 shares in the last quarter. CANADA LIFE ASSURANCE Co grew its position in shares of Vertex by 39.1% during the 2nd quarter. CANADA LIFE ASSURANCE Co now owns 7,311 shares of the company's stock worth $259,000 after purchasing an additional 2,055 shares in the last quarter. Finally, Tower Research Capital LLC TRC raised its position in shares of Vertex by 363.3% in the second quarter. Tower Research Capital LLC TRC now owns 8,070 shares of the company's stock valued at $285,000 after buying an additional 6,328 shares in the last quarter. Institutional investors and hedge funds own 70.32% of the company's stock.

About Vertex

(

Get Free Report)

Vertex, Inc, together with its subsidiaries, provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally. The company offers tax determination; compliance and reporting, including workflow management tools, role-based security, and event logging; tax data management; document management; analytics and insights; pre-built integration that includes mapping data fields, and business logic and configurations; industry-specific solutions; and technology specific solutions, such as chain flow accelerator and SAP-specific tools.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vertex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertex wasn't on the list.

While Vertex currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.