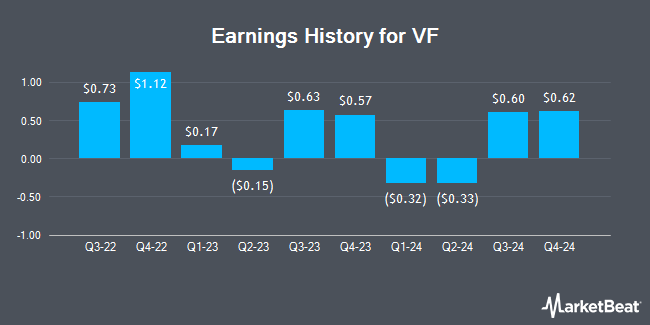

VF (NYSE:VFC - Get Free Report) will likely be posting its Q4 2025 quarterly earnings results before the market opens on Wednesday, May 21st. Analysts expect VF to post earnings of ($0.15) per share and revenue of $2.17 billion for the quarter.

VF Stock Performance

Shares of VFC opened at $14.94 on Wednesday. The company's fifty day moving average is $13.57 and its 200-day moving average is $19.43. VF has a 12 month low of $9.41 and a 12 month high of $29.02. The firm has a market cap of $5.82 billion, a price-to-earnings ratio of -12.55, a price-to-earnings-growth ratio of 6.77 and a beta of 1.68. The company has a quick ratio of 1.00, a current ratio of 1.56 and a debt-to-equity ratio of 2.31.

Wall Street Analyst Weigh In

Several equities analysts have commented on VFC shares. Stifel Nicolaus lowered their price target on VF from $35.00 to $28.00 and set a "buy" rating on the stock in a report on Thursday, April 10th. Needham & Company LLC reiterated a "buy" rating and issued a $28.00 target price on shares of VF in a research note on Friday, March 7th. Jefferies Financial Group raised their target price on shares of VF from $21.00 to $24.00 and gave the company a "hold" rating in a research note on Tuesday, January 28th. Truist Financial reaffirmed a "hold" rating and issued a $24.00 price target (up from $20.00) on shares of VF in a research report on Thursday, January 30th. Finally, Telsey Advisory Group reaffirmed a "market perform" rating and issued a $27.00 price target on shares of VF in a research report on Friday, March 7th. One equities research analyst has rated the stock with a sell rating, fifteen have issued a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat.com, VF has a consensus rating of "Hold" and an average target price of $20.65.

Get Our Latest Report on VFC

VF Company Profile

(

Get Free Report)

VF Corp. engages in the business of producing and marketing apparel, footwear, and accessories. It operates through the following segments: Outdoor, Active, Work, and Other. The Outdoor segment includes authentic outdoor-based lifestyle brands such as performance-based and outdoor apparel, footwear, and equipment.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider VF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VF wasn't on the list.

While VF currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.